Energy for the world, society, and people's lives. To contribute to growing society and establish a vibrant future through creations and innovations in energy, resources, and materials.

The ENEOS Group by Numbers

-

*1: FY2023 financial results (announced May 14, 2024)

*2: Operating income excluding inventory impact

(impact on profits caused by changes in costs and prices) - Consolidated sales*1

13,856.7 billion yen

- Consolidated operating income*1

464.9 billion yen

- Operating income excluding inventory impact

393.2 billion yen

FY2023 operating income results

| FY2023 operating income results: |

3,932 |

|---|---|

| Energy: |

1,813 |

| Petroleum and natural gas development: |

915 |

| Metal: |

811 |

| Other: |

393 |

- Consolidated employees

43,683

-

as of March 31, 2024

- Women in

managerial positions58

-

As of April 2024, ENEOS results

- Advanced digital

human resources1,900

-

As of March 2024

-

as of March 31, 2024

-

Domestic service station share

-

No.1 in Japan

-

About 44 %

-

Crude oil processing capacity

-

1.64 million barrels a day

-

As of June 30, 2024

-

Renewable

energy generation -

As of June 30, 2024,

including projects under construction -

1.27 million kW

ENEOS Group Business

Supporting everyone's "today's normal" through the stable provision of energy and materials for over 130 years. We will face societal challenges in all ages and continue to be a business group that delivers "tomorrow's normal."

The ENEOS Group is striving to develop multiple next-generation energies for carbon neutrality to handle various scenarios.

- Petroleum Products Business

- Oil & Natural Gas E&P Business

- High Performance Materials Business

- Electricity Business

- Renewable Energy Business

-

Petroleum Products Business

The ENEOS group is taking on the challenge of achieving both a stable supply of energy and materials and the realization of a carbon-neutral society.

1 Gasoline+Kerosene+Diesel Fuel+Fuel Oil A

2 FY2023 actual: No1 in Japan1 Gasoline+Kerosene+Diesel Fuel+Fuel Oil A

2 FY2023 actual: No1 in Japan

3 As of end of June, 2024

3 As of end of June, 2024

-

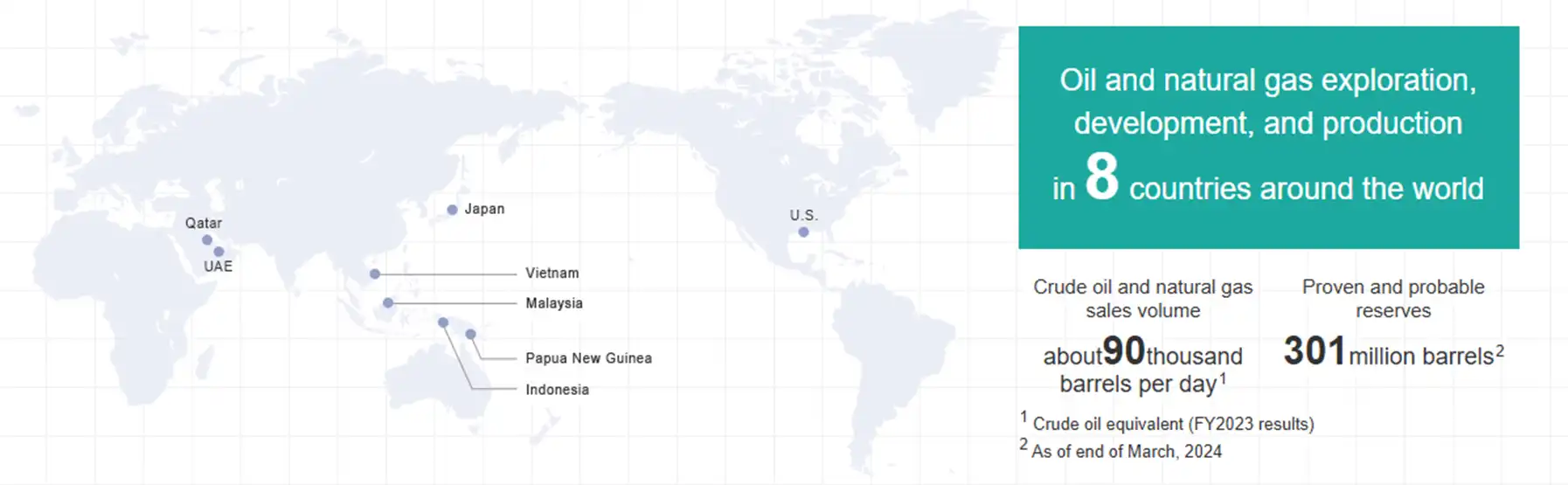

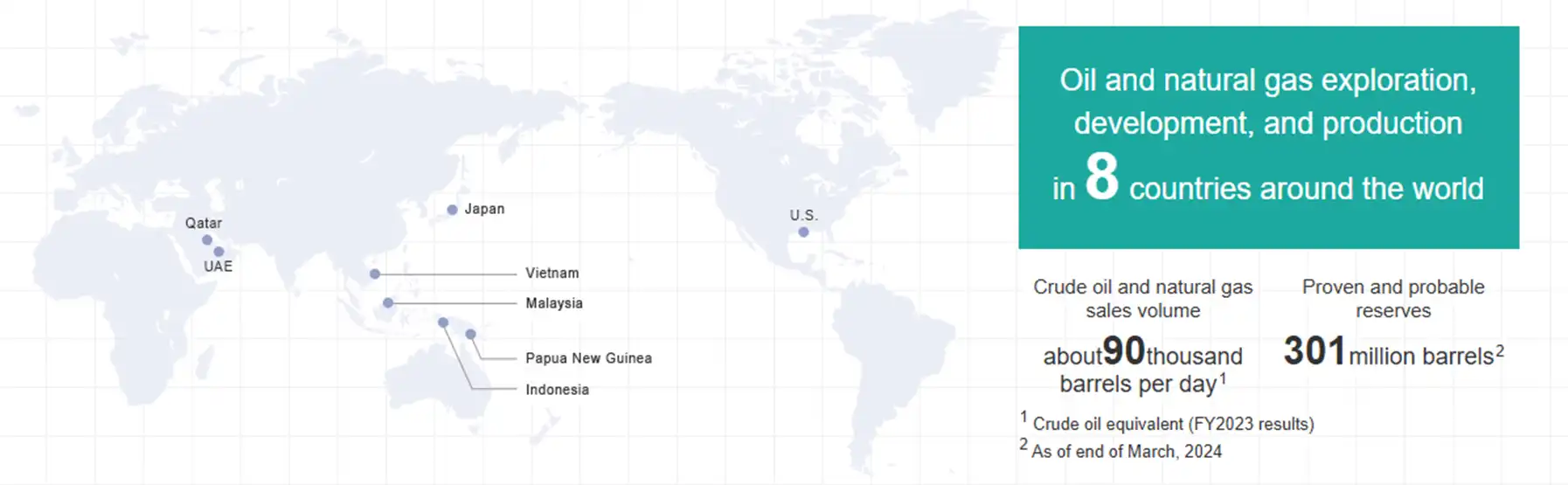

Oil & Natural Gas E&P Business

ENEOS Xplora Inc. is moving ahead

with the development of petroleum and natural gas resources, with the utmost attention to safety and the environment.

-

High Performance Materials Business

We contribute to the development of society, people's lives, and a vibrant future through creativity and innovation in materials.

-

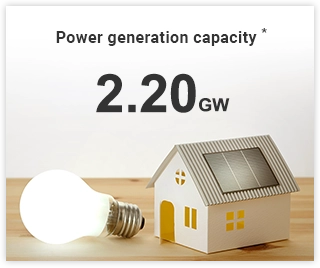

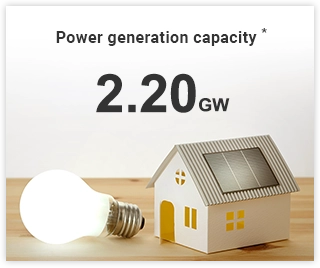

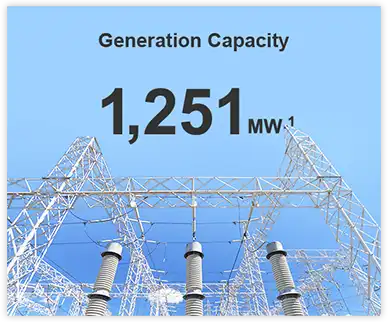

Electricity Business

We will continue to strive to create a bright and shining future by providing a variety of energy services that meet the needs of our customers and society.

¹ As of the end of December 2023

¹ As of the end of December 2023

² Power sources owned by ENEOS Power and ENEOS in Japan (as of March 2024)

² Power sources owned by ENEOS Power and ENEOS in Japan (as of March 2024)

-

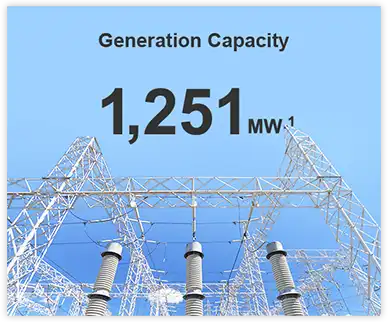

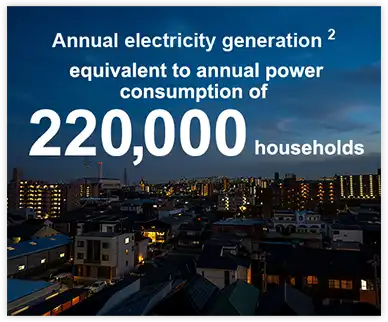

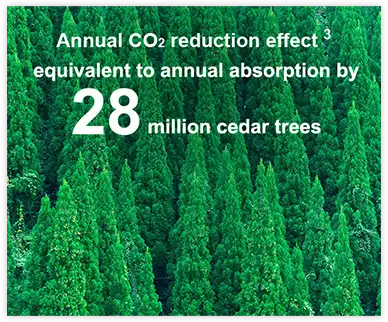

Renewable Energy Business

We contribute to the realization of a decarbonized society through the development and operation of renewable energy power plants.

¹ As of December 2023

¹ As of December 2023

² As of 2022

² As of 2022

³ As of 2022

³ As of 2022

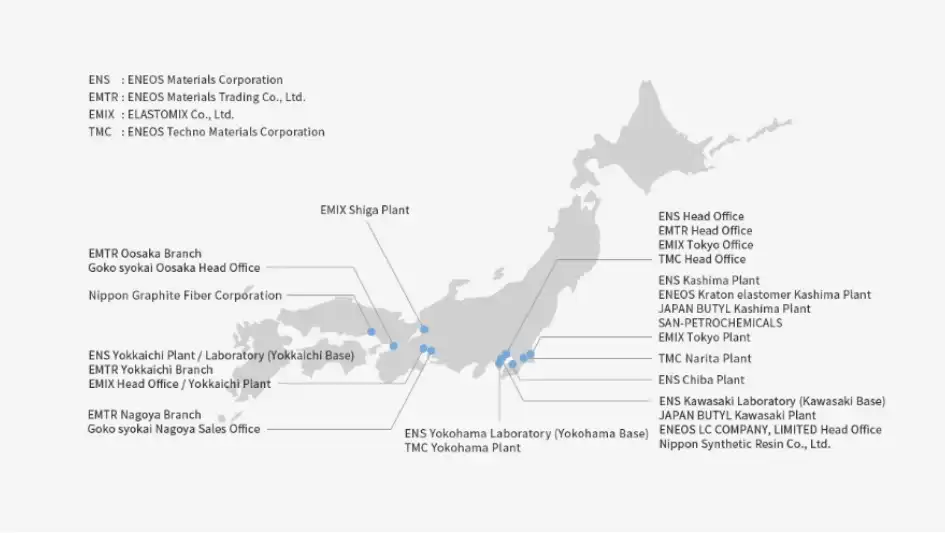

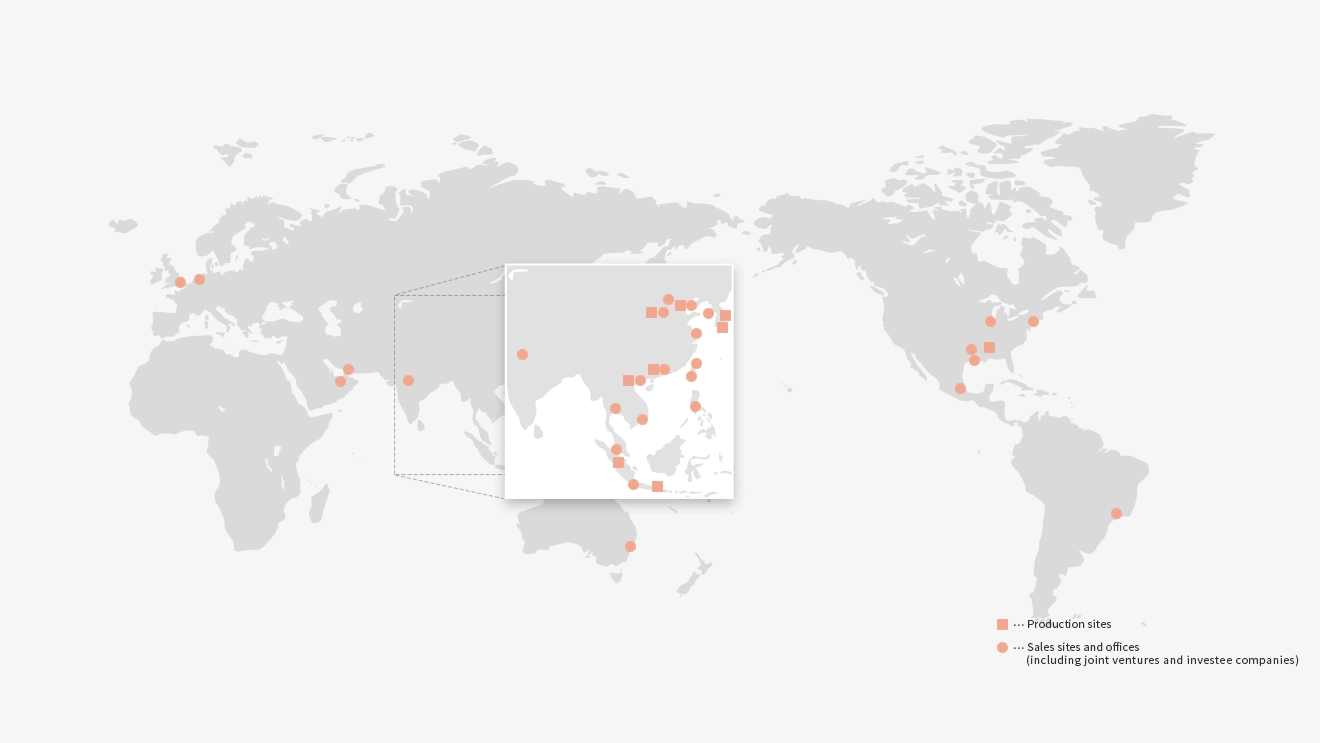

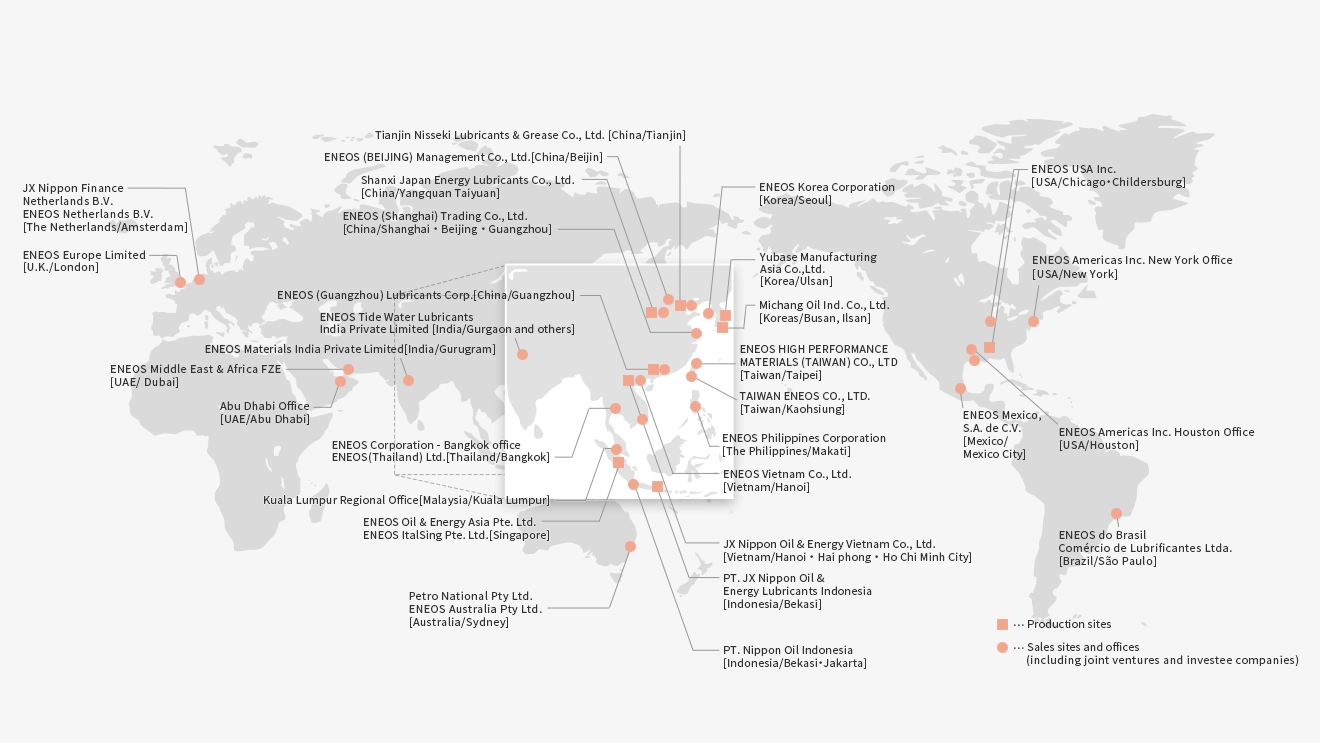

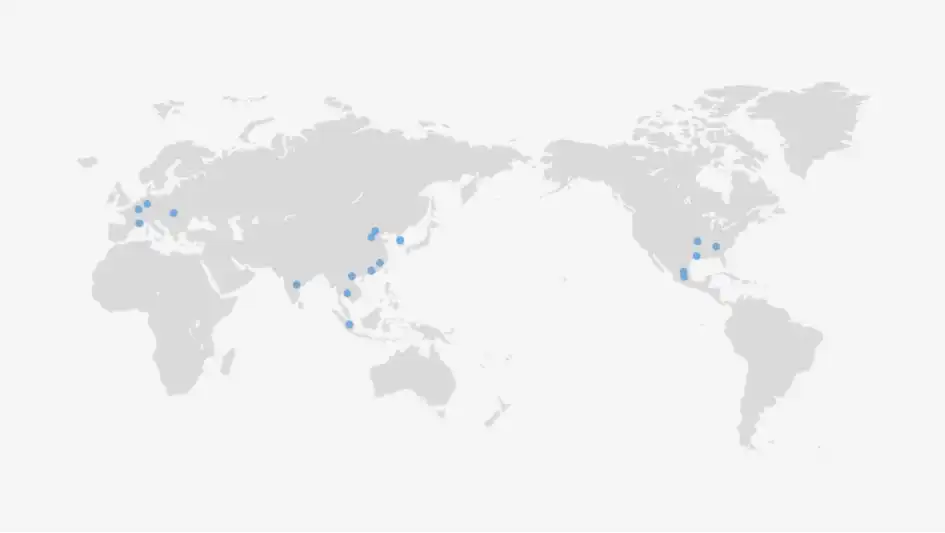

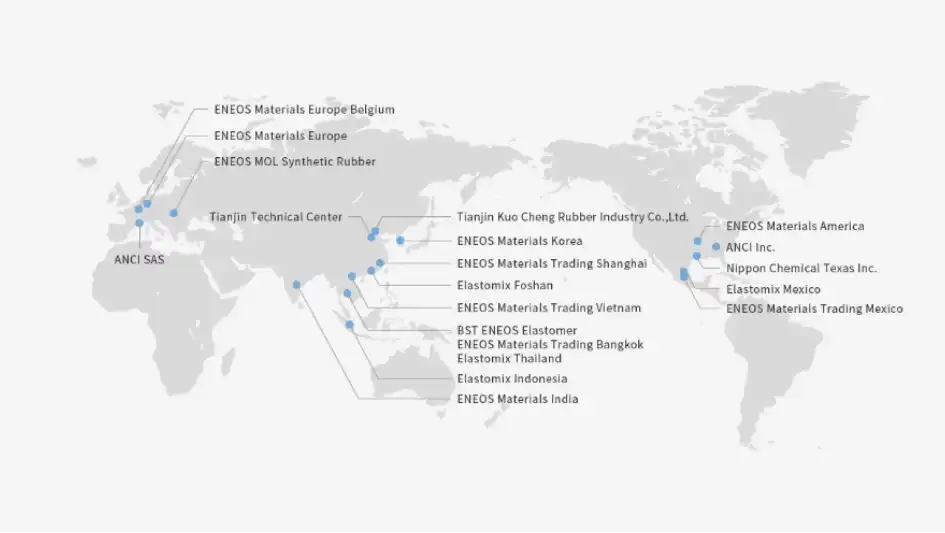

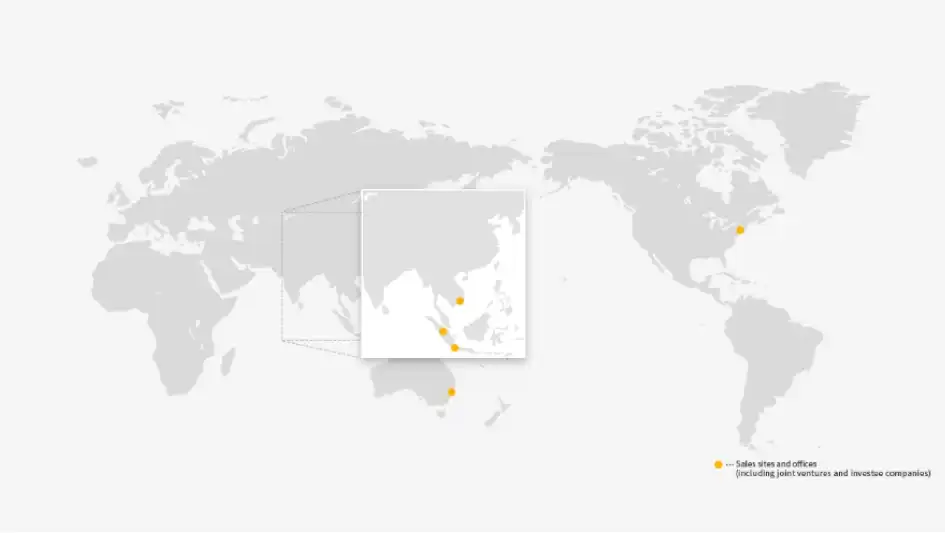

ENEOS Group Locations Across the World

- Domestic

- Overseas

- Petroleum Products Business

- Oil & Natural Gas E&P Business

- High Performance Materials Business

- Electricity Business

- Renewable Energy Business

-

- Hide business site name

- Display business site name

-

- Hide business site name

- Display business site name

-

- Hide business site name

- Display business site name

-

- Hide business site name

- Display business site name

- Petroleum Products Business

- Oil & Natural Gas E&P Business

- High Performance Materials Business

- Electricity Business

- Renewable Energy Business

-

- Hide company (country) name

- Display company (country) name

-

- Hide company (country) name

- Display company (country) name

-

- Hide company (country) name

- Display company (country) name

-

- Hide company (country) name

- Display company (country) name

ENEOS Group's Ideal

ENEOS Group Philosophy

Long-Term Vision

The ENEOS Group will take on the challenge of achieving both a stable supply of energy and materials and the building of a carbon-neutral society.

We will help achieve a carbon-neutral society through energy transitions while fulfilling our responsibility to provide a stable supply of energy and materials now and in the future. We, the ENEOS Group, will strive to maximize our corporate value by steadily carrying out these tasks, which are also major challenges for the human race.