Terms like "inventory valuation effects," "net income excluding inventory valuation effects," and "net operating profit excluding inventory valuation effects" appear in financial statements from the ENEOS Group.

Understanding inventory valuation effects is essential to correctly comprehending our reports.

Inventory Valuation Eeffects

Based on the accounting rules at the ENEOS Group, inventory valuation effect is the effect on net income from inventory valuations.

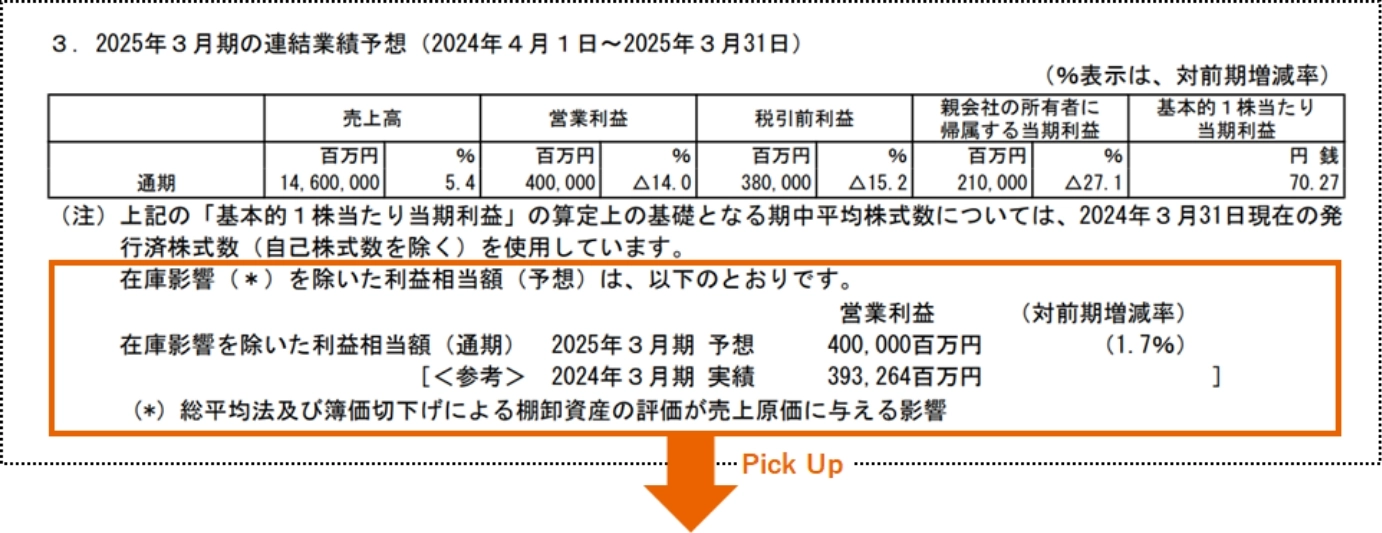

[reference: ENEOS Group financial results excerpt (announced May 2024)]

Below is profit (forecast) excluding inventory valuation effects.

| Operating income | |

|---|---|

| Profit excluding inventory valuation effects (full-year) |

Forecast for fiscal year ending March 31, 2025 (FY2024)

400,000 million yen |

| <Reference> |

Results for fiscal year ended March 31, 2024 (FY2023)

393,264 million yen |

Why Separate Inventory Valuation Effects?

Why is it necessary to report inventory valuation effects separately in results?

Petroleum distributors are required by law (Oil Stockpiling Act) to stockpile 70 days’ worth of petroleum (private stockpile). Therefore, the industry is special because a relatively large inventory compared to other industries is maintained even during normal circumstances.

[Fluctuation of crude oil prices]

The main valuation indicator of inventory, crude oil price, is easily affected by geopolitical factors, and it tends to fluctuate widely.

Because of this, stockpiled inventory widely impacts net income when crude oil price rises or falls significantly. Since inventory valuation effects can fluctuate widely depending on external factors like crude oil price, "net income excluding inventory valuation effects" and "net operating profit excluding inventory valuation effects" which subtract the effects are important indicators for understanding the Group's actual earnings.

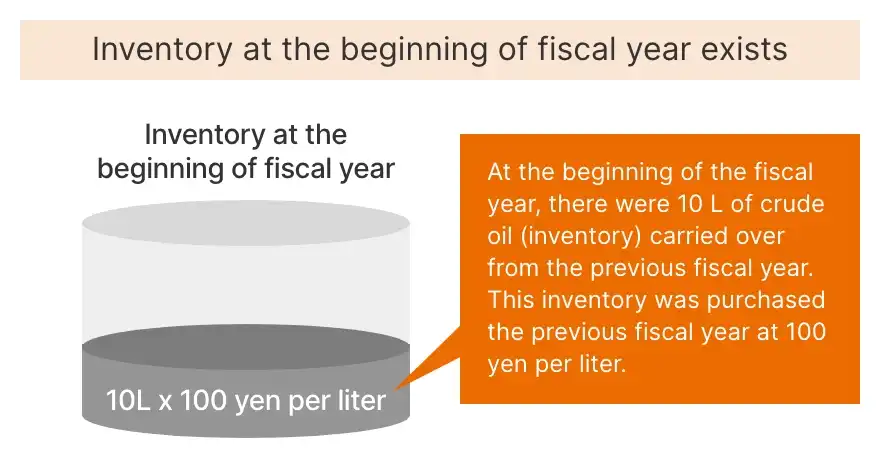

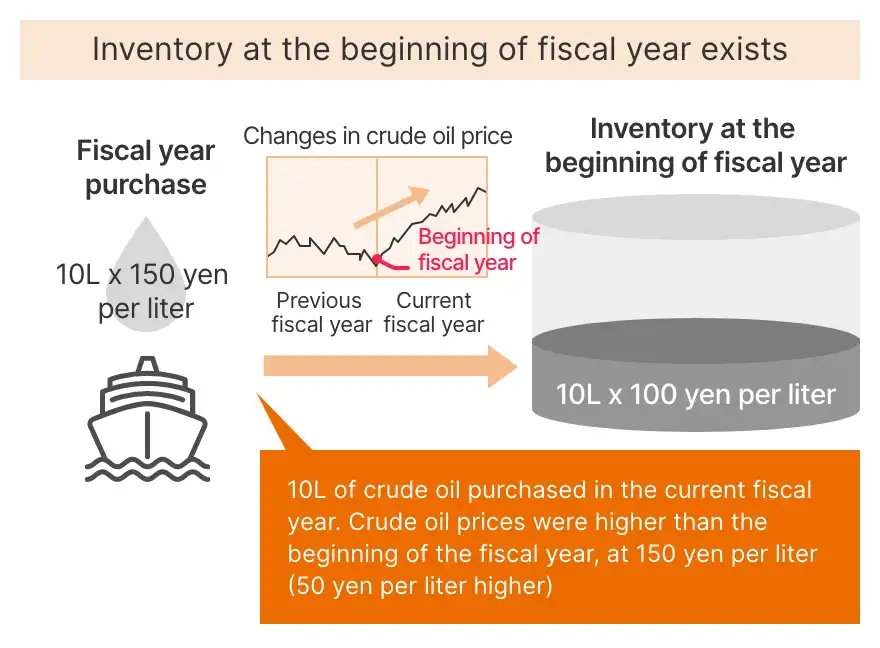

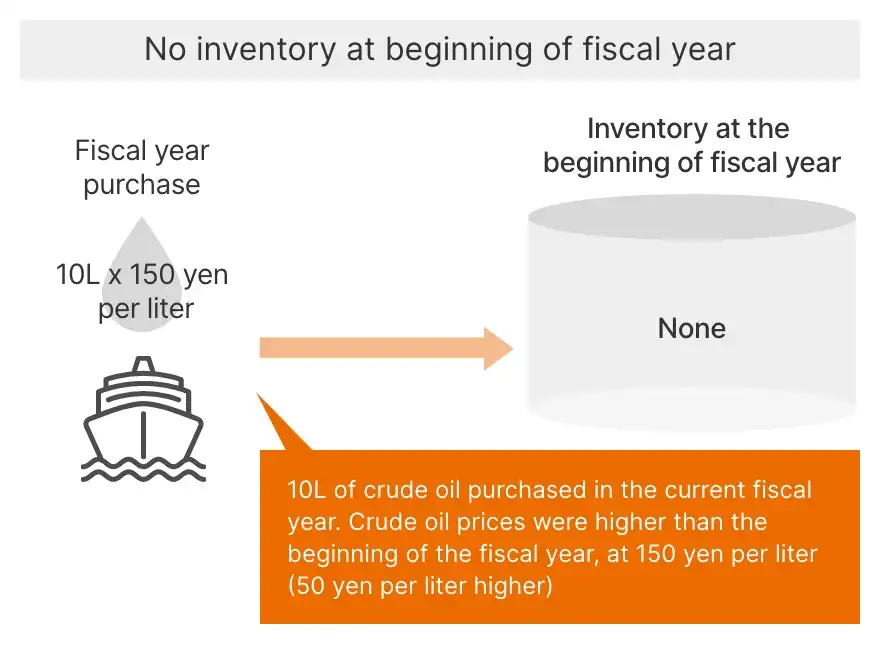

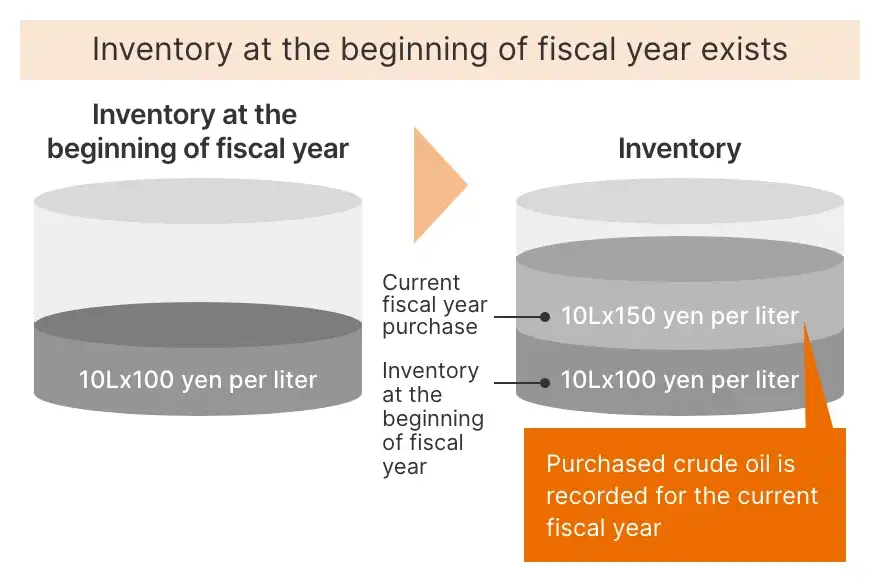

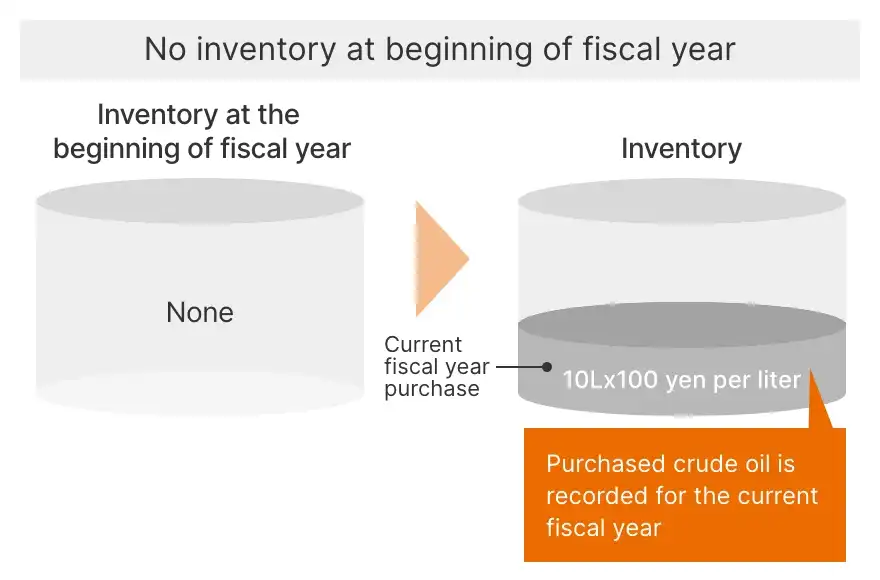

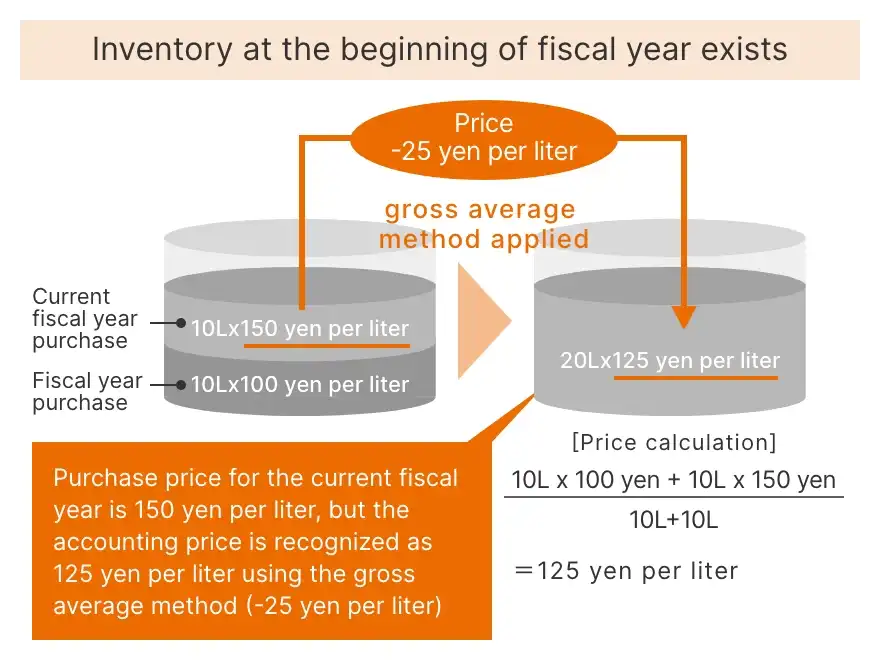

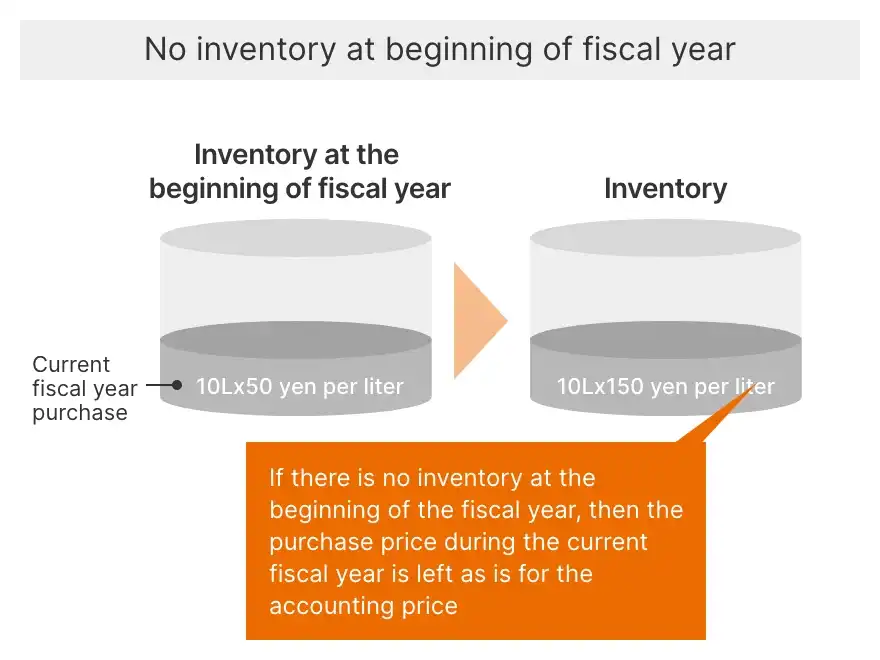

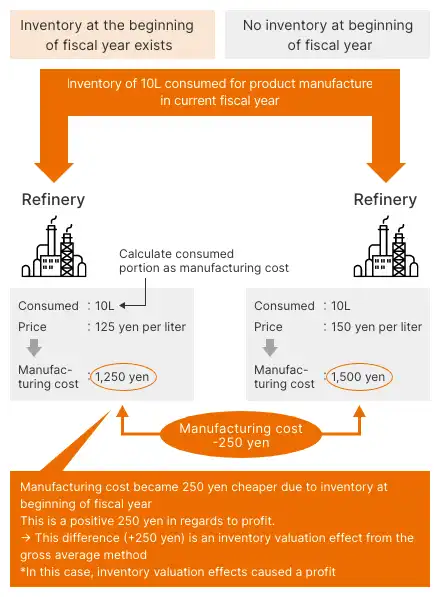

Let us look at the images below of real-life examples.

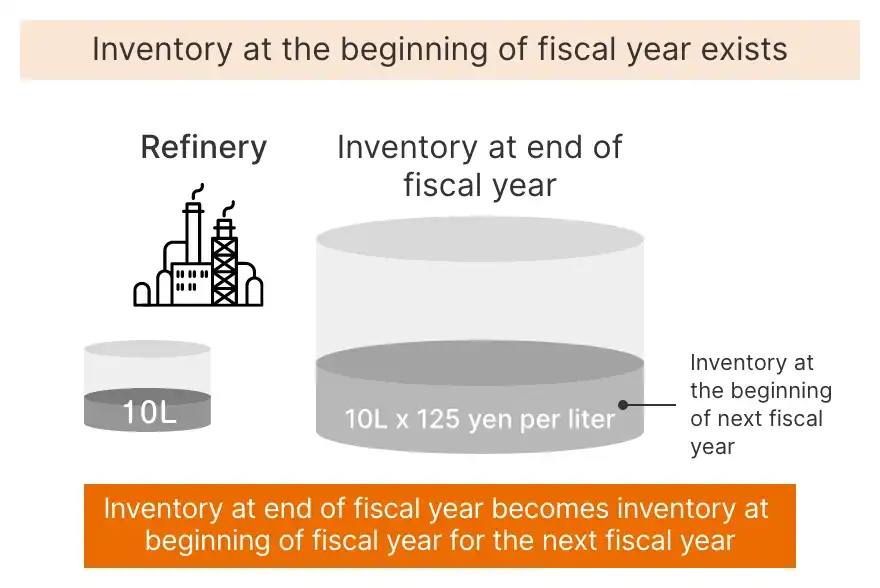

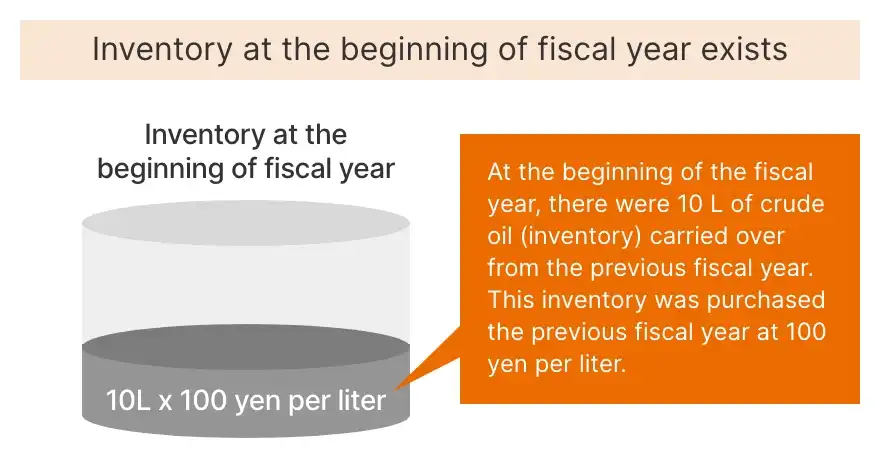

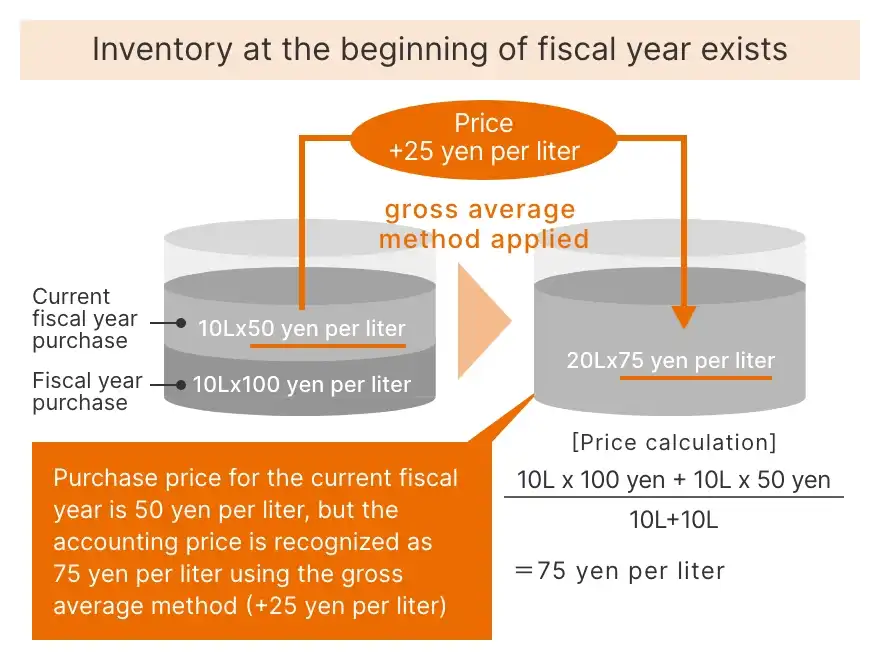

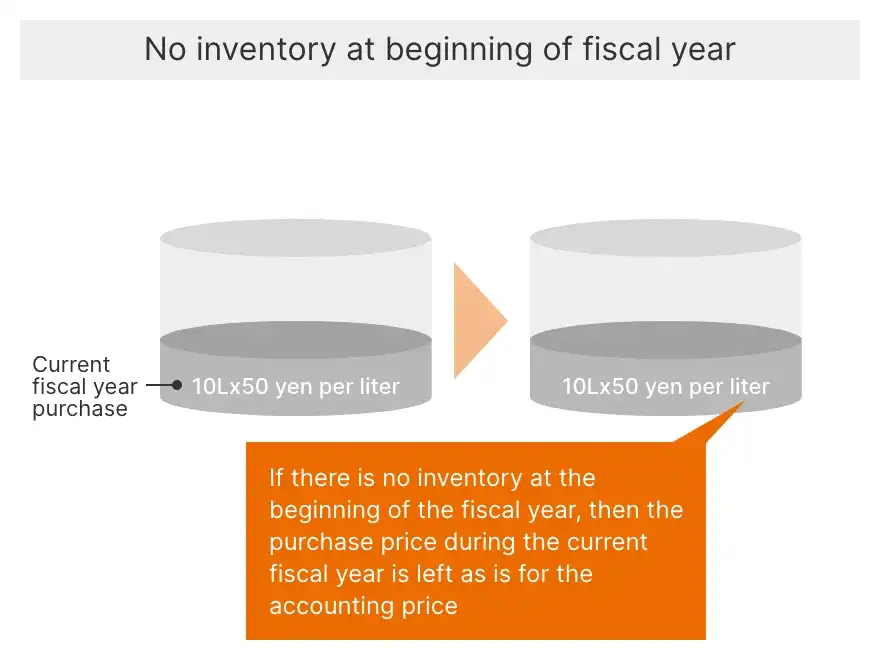

The price difference when there are valuations of "inventory at beginning of fiscal year (gross average method)" and "no inventory at beginning of fiscal year" are calculated as inventory valuation effects.

Case 1: Increased crude oil price after the beginning of the fiscal year

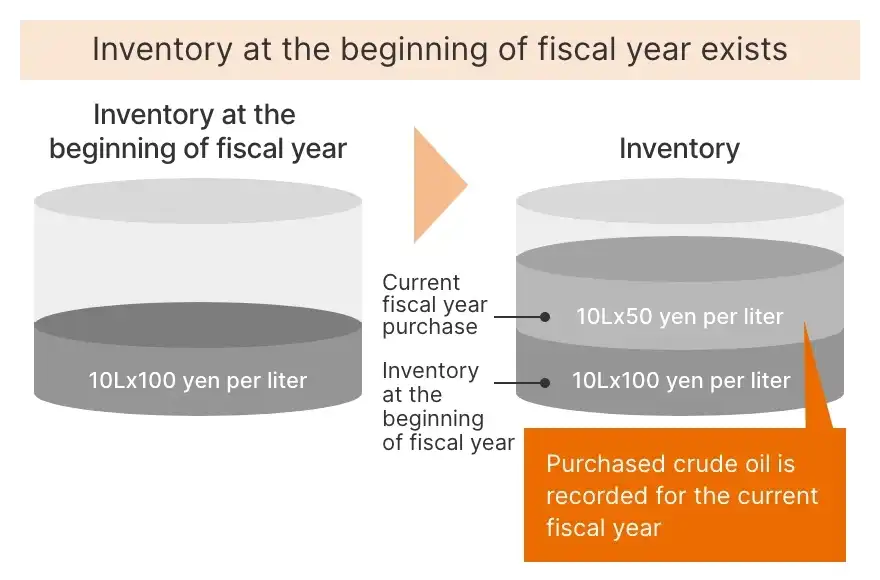

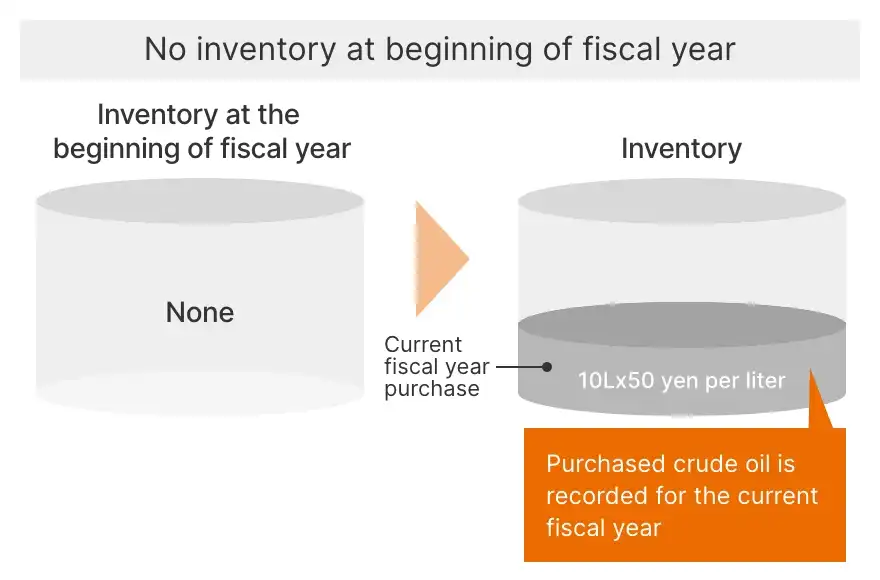

Let us compare situations where there is inventory at the beginning of the fiscal year and one where there is not.

When price of inventory at the beginning of the fiscal year is lower than interim purchase price

STEP1

STEP2

STEP3

STEP4

STEP5

STEP6

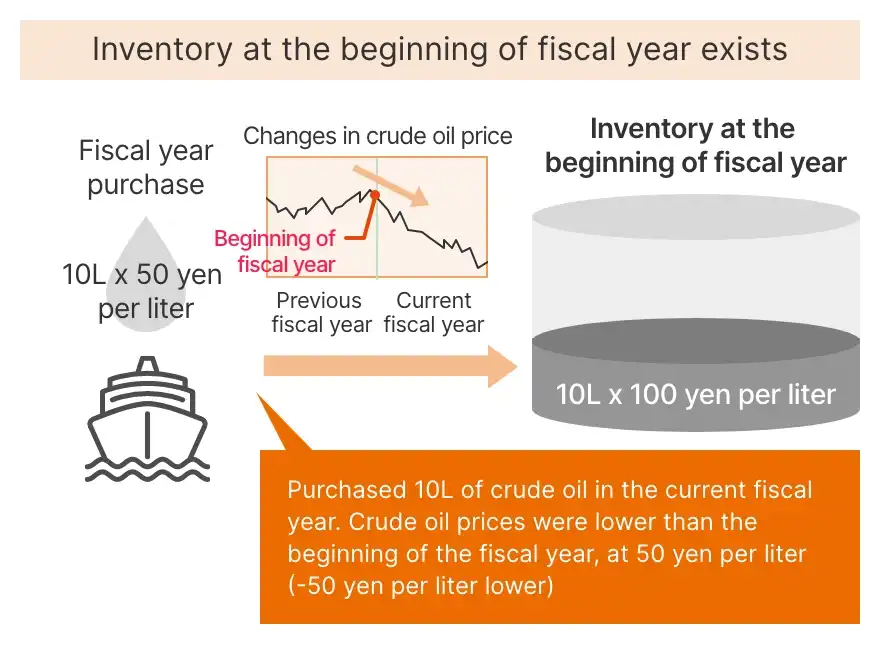

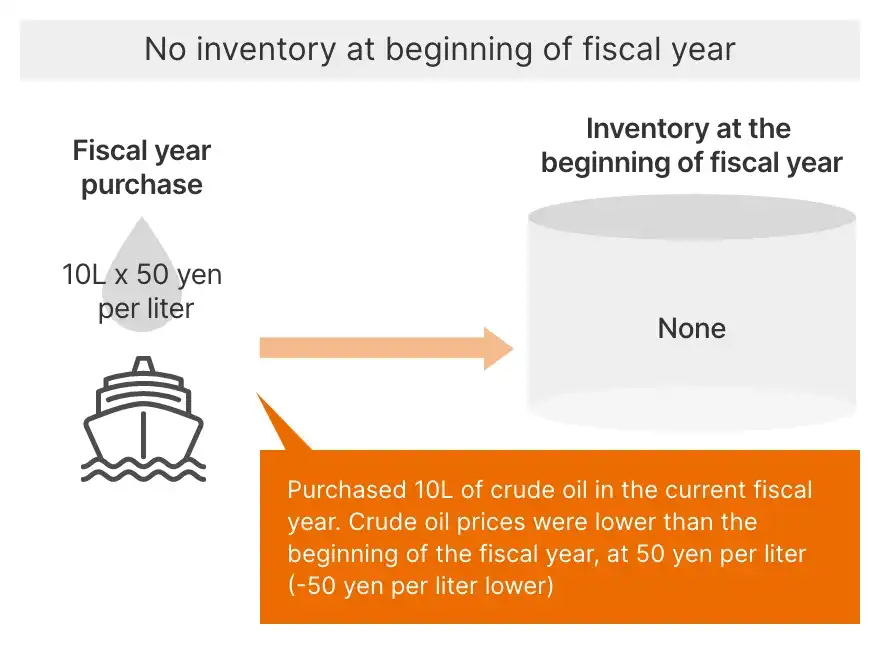

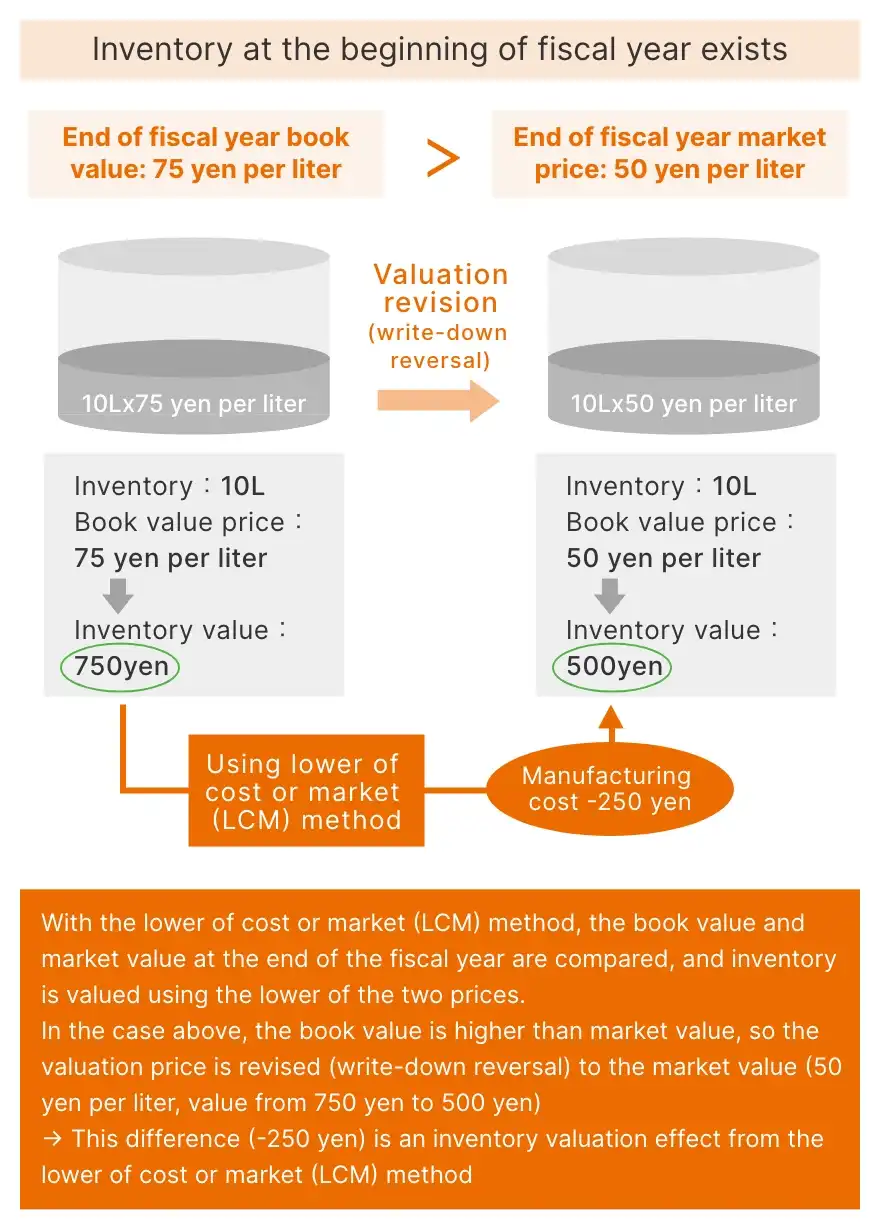

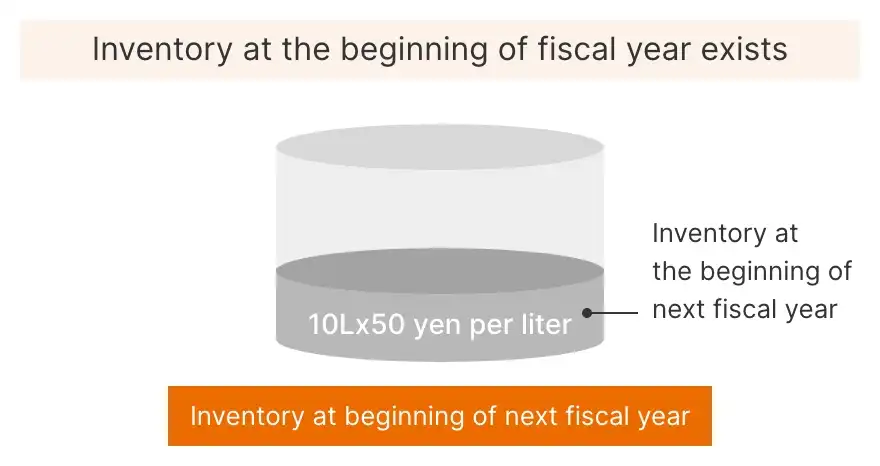

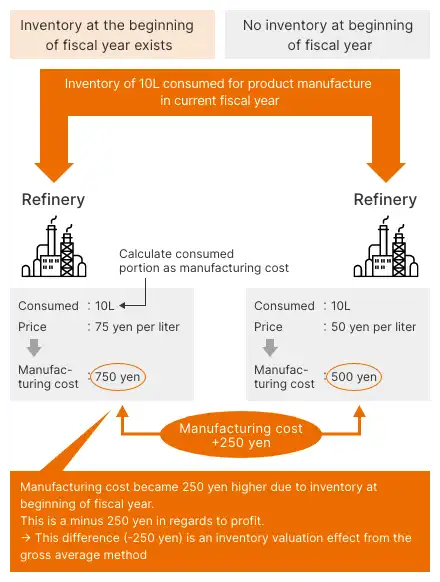

Case 2: Decreased crude oil price after the beginning of the fiscal year

Let us look at a case where crude oil price has decreased (approach is the same until Step 5).

Case where price of inventory at the beginning of the fiscal year is higher than interim purchase price

STEP1

STEP2

STEP3

STEP4

STEP5

STEP6

The -250 yen from the gross average method in Step 5 and the -250 yen from the lower of cost or market (LCM) method in Step 6 results in a total inventory valuation effect of -500 yen

*In this case, inventory value effects caused a loss

STEP7

Lastly

These images focused on prices (costs) to explain the points.

Petroleum companies stock crude oil and sell products refined from it, and purchase price and sale price reflect the crude oil price at that time. Therefore, net income that excludes inventory valuation effects is closer to the real changes in money.

Therefore, in ENEOS Group financial statements, we disclose "net income excluding inventory valuation effects," and "net operating profit excluding inventory valuation effects" in addition to net income and net operating profit (including inventory valuation effects for both) for accounting purposes.

Inventory valuation effects can be very large for certain accounting periods, but they even out over the long term.

-

The gross average method we use as a valuation method for inventory has been described, but there are several other methods. Matters have been kept simple for explanatory purposes, but please see books specializing in accounting for a more detailed understanding.