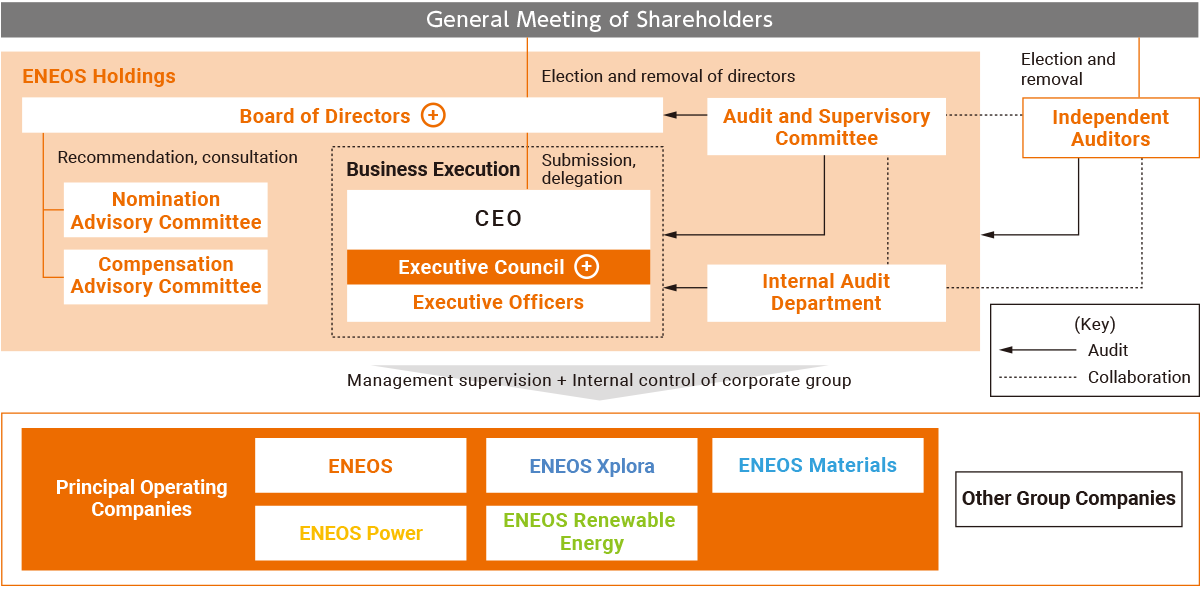

Corporate Governance Framework

Basic Approach

ENEOS Holdings has established the ENEOS Group Philosophy as the foundation for the Group’s business activities, and works to realize the philosophy through the establishment and appropriate execution of corporate governance to achieve sustainable growth and enhance the corporate value of the Group over the medium to long term.

Corporate governance of the ENEOS Group is structured and executed as follows.

Basic Policy on Corporate Governance

To achieve sustainable growth and increase the corporate value of the Group over the medium to long term, the Company established the Basic Policy on Corporate Governance of ENEOS Group with the objective of establishing and operating a corporate governance framework for the conduct of transparent, fair, timely, and decisive decision-making in the Group’s management.

The policy describes systematically and comprehensively the Group’s basic approach to corporate governance as well as its establishment and operation, taking into consideration the Corporate Governance Code established by the Tokyo Stock Exchange.

The policy, published on the Company’s website, is our commitment to all stakeholders, including shareholders of ENEOS Holdings, Group customers, business partners, employees, and local communities.

- Basic Policy on Corporate Governance of ENEOS Group

- (Exhibit 1) ENEOS Group Code of Conduct

- (Exhibit 2) Medium-Term Management Plan

- (Exhibit 3) Basic Policy on Internal Control System

- (Exhibit 4) Standards for Consideration of Independence of Independent Directors

- (Exhibit 5) Disclosure Policy

- (Exhibit 6) Shareholder Return Policy and Capital Policy

- Corporate Governance Report (Available in Japanese only) (updated November 25,2025)

Basic Matters on the Establishment and Operation of Corporate Governance

- 1.Business management as the holding company

- The Company takes charge of formulating the ENEOS Group Philosophy, ENEOS Group Code of Conduct, basic management policies such as medium- to long-term management plans and budgets (hereinafter referred to as “Basic Management Policies”), allocating management resources and overseeing the management of each subsidiary from the perspective of optimizing the value of ENEOS Group as a whole.

- 2.Management structure of the Company and the Principal Operating Companies

- In order to strongly advance portfolio management under the Company’s strong leadership, ENEOS Group has established a structure, under which the Company serves as a holding company and five operating Companies which promote each principal business are placed thereunder.

The Principal Operating Companies: ENEOS Corporation, ENEOS Xplora Inc., ENEOS Materials Corporation, ENEOS Power Corporation, and ENEOS Renewable Energy Corporation shall respectively establish business execution structure where their autonomy, agility, and independence are further enhanced depending on their business characteristics under the Basic Management Policies specified by the Company.

- 3.Organization

- The Company is a company with audit and supervisory committee.

- 4.Board of Directors

- The Board of Directors of the Company consists of more than one inside directors and outside directors, which is chaired by an outside director. With such composition, the Board of Directors of the Company shall manage the Company in accordance with the following policies.

- (1) Focus on deliberation and decision of the Basic Management Policies and oversight of the execution of operations.

- (2) As an effort to improve agility of the execution of operations, delegate part of decision-making on the execution of material operations to the CEO of the Company through a director.

- (3) With respect to the material matters such as appraisal of return on investment, risks, progress of execution of material operations of the Company and the Principal Operating Companies, the Board of Directors shall receive reports from persons such as the CEO of the Company and the President of each Principal Operating Company, verify its consistency with the Basic Management Policies and oversee such matters.

- 5.Audit and Supervisory Committee

-

- (1) The Audit and Supervisory Committee shall carry out audits with a high degree of effectiveness and objectivity conduct audits with a Chairman of an outside director in an organized and systematic fashion through appropriate collaboration between the full-time audit and supervisory committee members, who are given the strong power to gather information, and the audit and supervisory committee members who are outside directors, who have a high degree of independence, in addition to a wealth of knowledge and experience.

- (2)The Audit and Supervisory Committee shall oversee the execution of operations through each audit and supervisory committee member exercising the voting right that he or she has as a director at the Board of Directors meetings as well as exercising the right to state his or her opinion on personnel affairs and compensation of directors who are not audit and supervisory committee members.

- 6.Outside directors

- To take advantage of a wealth of knowledge and experience of outside directors and to ensure transparency and objectivity in decision-making, the Company shall take the following measures:

- (1) in determining the Basic Management Policies at the Board of Directors of the Company, request outside directors to be involved, from the stage of consideration and to fully discuss it from multiple points of view; and in decision-making on and overseeing execution of material operations, fully verify its consistency with the Basic Management Policies, taking opinions of outside directors into account; and

- (2) in determining personnel affairs and remuneration of directors at the Board of Directors of the Company, ensure transparency of the decision-making process by consulting with the Nomination Advisory Committee and the Compensation Advisory Committee, a majority of whose members are outside directors, and which are chaired by an outside director.

- 7.Executive officers, Group Chief Officers, and the Executive Council

-

- (1) The Company shall appoint executive officers who execute operations agilely pursuant to a decision of the Board of Directors.

- (2)In order to enhance group governance, the Company shall appoint Group Chief Officers as the roles by which strengthening collaboration among the Principal Operating Companies, optimizing resource allocation, etc.

- (3)For the CEO to execute operations, the Company shall establish the Executive Council as a consultative body for matters to be decided by the CEO, which shall consist of the CEO, the Executive Vice Presidents, the Senior Vice Presidents who have been appointed by the CEO, and the President of each Principal Operating Company, and have the Executive Council make decisions through careful deliberations.

- (4)A full-time audit and supervisory committee members shall attend the Executive Council, grasp a process of important decision-making, and the status of execution of operations, and share such process and status with other audit and supervisory committee members.

- 8.Corporate governance framework of Principal Operating Companies

-

- (1) Each Principal Operating Company is a company with audit and supervisory committee or company with board of corporate auditors (as defined in the Companies Act of Japan). Each Principal Operating Company has a Board of Directors to enable directors to oversee each other’s performance of duties. Each Principal Operating Company shall fully analyze the risk of the business and verify the conformity of the execution of operations performance to the Basic Management Policies. The Company shall dispatch, if necessary, its full-time audit and supervisory committee member to the Principal Operating Companies as a part-time director who is an audit and supervisory committee member or a part-time corporate auditor, and cause such director or corporate auditor to audit the execution of the duties by the directors of the Principal Operating Company.

- (2) Any decision-making regarding the matters related to the execution of operations of a Principal Operating Company (including matters on the execution of material operations of a subsidiary of such Principal Operating Company) shall be made by such Principal Operating Company.

- (3)Each Principal Operating Company shall report to the Company the status and other matters established by the Company regarding the execution of material operations.

- (4)In order to appropriately monitor the Board of Directors of the Principal Operating Companies or audit the execution of the duties by the directors of the Principal Operating Companies, the Company shall dispatch, if necessary, its Executive Vice Presidents or Senior Vice Presidents to the Principal Operating Companies as part-time directors who are not audit and supervisory committee members or part-time directors, or part-time director who are audit and supervisory committee members or part-time corporate auditors of the Principal Operating Companies.

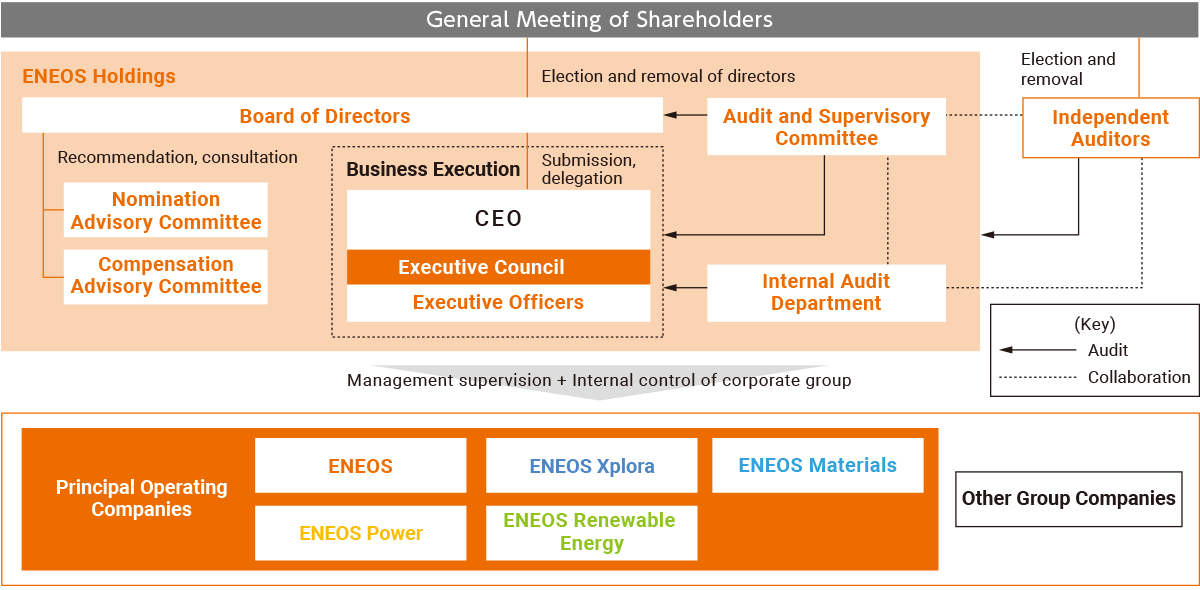

Structure

Corporate Governance Framework

Board of Directors

The Board of Directors makes decisions on matters stipulated by laws, regulations, or the Articles of Incorporation; the medium-term management plan; important matters regarding business execution for the Company and Principal Operating Companies; etc.

Executive Council

The Executive Council has been formed to discuss matters related to operational execution that require the approval of the CEO. This council is composed of the CEO, the Executive Vice Presidents, the Senior Vice Presidents who have been appointed by the CEO, and the CEO/President of each Principal Operating Company.

Thus, at the Executive Council, through careful deliberation by executive members of the Company and the Principal Operating Companies, appropriate and efficient decisions by the CEO are secured.

Corporate Governance Framework at a Glance (As of June 26, 2025)

| Item | Details |

|---|---|

| Organization format | Company with an audit and supervisory committee |

| Number of directors who are not Audit and Supervisory Committee members* | 6 (2 inside, 4 outside) |

| Number of directors who are Audit and Supervisory Committee members* | 4 (1 inside, 3 outside) |

| Total number of directors | 10 (3 inside, 7 outside; 4 female directors) |

| Percentage of outside (independent) directors | 70% |

| Percentage of female directors | 40% |

| Chairman of the Board of Directors | Outside director |

| Term of directors who are not Audit and Supervisory Committee members | 1 year |

| Term of directors who are Audit and Supervisory Committee members | 2 years |

| Adoption of executive officer system | Yes |

| Decision-making body for the appointment and dismissal of directors | General Meeting of Shareholders |

| Decision-making body for the upper limit of director remuneration | General Meeting of Shareholders |

| Institution assisting the CEO’s decision-making | Executive Council |

| Voluntary advisory committees for the Board of Directors | Nomination Advisory Committee and Compensation Advisory Committee (1 inside, 4 outside; chairman: outside director) |

| Term of Independent Auditors | 1 year |

- * At the most recent General Meeting of Shareholders (15th Ordinary General Meeting of Shareholders), no directors received 10% or more opposing votes.

Overview of the Board of Directors and Fiscal 2024 Results

| Item | Details |

|---|---|

| Overview | The Board of Directors of the Company consists of more than one inside directors and outside directors, which is chaired by an outside director. With such composition, the Board of Directors of the Company shall manage the Company in accordance with the following policies.

|

| Chairman | Outside director (Kawasaki Hiroko)* |

| Results for fiscal 2024 | The Board of Directors met 16 times, primarily to discuss the formulation of the fourth Medium-Term Management Plan, including the key points listed below. The Board also discussed matters such as the listing policy for JX Advanced Metals.

|

- * For director profiles, see Executives.

Overview of the Nomination Advisory Committee and Compensation Advisory Committee and Fiscal 2024 Results

| Nomination Advisory Committee | Compensation Advisory Committee | |

|---|---|---|

| Overview | To ensure the transparency of the process for determining the director candidates of the Company, the Nomination Advisory Committee, the majority of whose members are independent outside directors, has been established to provide advice to the Board of Directors about personnel matters involving the Company’s directors (including appointment and dismissal). The Nomination Advisory Committee is composed of five directors, four of whom are outside directors1,2, and one of the outside directors on the committee acts as chairman. The Company’s Board of Directors receives advice from the Nomination Advisory Committee regarding succession planning for the Company’s chairman of the Board of Directors and CEO and for the CEOs/presidents of the principal operating companies. | To ensure the transparency and objectivity of the process for determining the remuneration and other benefits for directors and executive officers, the Compensation Advisory Committee, the majority of whose members are independent outside directors, has been established to provide advice to the Board of Directors. The Compensation Advisory Committee is composed of five directors, four of whom are outside directors1,2, and one of the outside directors on the committee acts as chairman. The Board of Directors requests the Compensation Advisory Committee to advise on policies for determining remuneration and other benefits for directors and executive officers, as well as the executive remuneration plan and remuneration amount. |

| Chairman | Outside director (Kawasaki Hiroko)3 | Outside director (Kawasaki Hiroko)3 |

| Purpose | Ensure the transparency of the process for determining director candidates | Ensure the transparency and objectivity of the process for determining the remuneration and other benefits for directors and executive officers |

| Results for fiscal 2024 | The committee met six times and deliberated on matters including the composition of the Board of Directors and the advisory committees, and the subjects and processes of the advisory function. | The committee met three times and deliberated on remuneration design tailored to business characteristics, and reviews of the bonus and share-based remuneration system. |

- 1Composition of the Nomination Advisory Committee and the Compensation Advisory Committee as of June 26, 2025

- 2To ensure constructive discussion between outside directors, who supervise management from an independent and objective perspective, and inside directors, who have the greatest familiarity with the status of management, etc. in the Group, the Nomination Advisory Committee and the Compensation Advisory Committee are each comprised of outside directors who are not Audit and Supervisory Committee members and the CEO.

- 3For director profiles, see Executives.

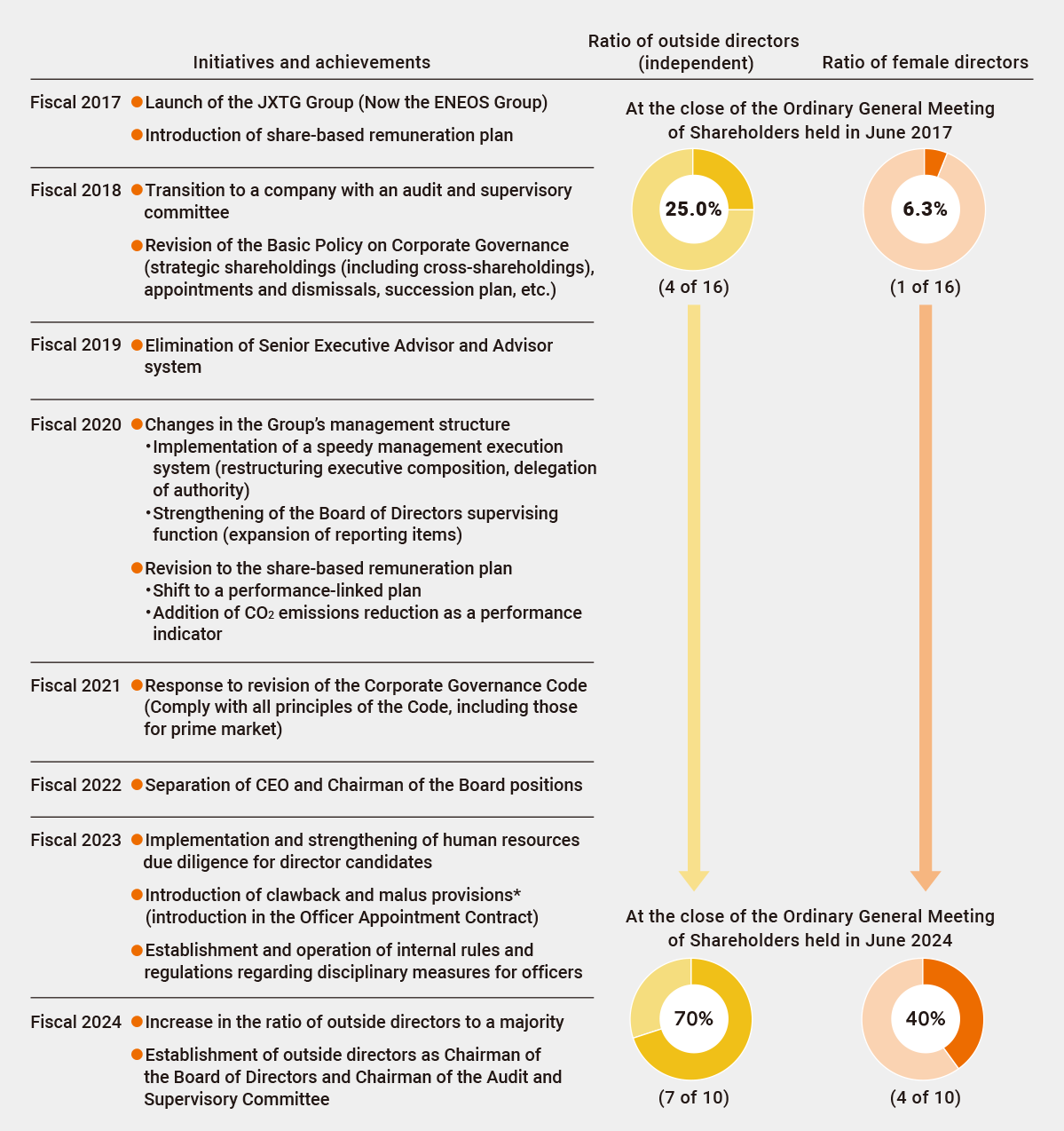

Strengthening Corporate Governance

Since the business integration in 2017, the Company has progressively implemented measures to strengthen corporate governance for the establishment of an appropriate management structure and operation of Group management.

Past Efforts to Strengthen Corporate Governance

- * Clawback provision: A clause requiring the return of all or part of officer remuneration after payment in the event of a material compliance violation

Malus provision: A clause preventing the vesting of all or part of officer remuneration before payment in the event of a material compliance violation

Comprehensive Recurrence Prevention Measures

With reference to issues identified regarding past inappropriate behavior by top management, we are rigorously implementing recurrence prevention measures.

- 1.Enhancement of Director Selection Process

- Enhancement of human resources due diligence when selecting directors (focusing on the risks of harassment, alcohol consumption, and deviation from norms)

- 2.Enhancement of Normative Awareness of Officers

- Declaration of compliance and commitment (CEOs/presidents of ENEOS Holdings and principal operating companies)

- Conduct compliance training four times a year with outside experts as instructors

- Complete a range of e-learning courses on general compliance and key laws and regulations

- 3.Behavioral Management of Directors

- Institution and operation of rules for directors attending social gatherings

- 4.Enhancement of Monitoring of Directors

- Implementation of upward feedback* for directors

- * An initiative for gaining objective feedback from colleagues on one’s own behavior and the status of day-to-day management

Material Issues, Plans and Results

Fiscal 2024 Targets, Results and Progress

Evaluation: Achieved/Steady progress Not achieved

| Material ESG Issue | Initiative | Target (KPI) | Results/Progress | |

|---|---|---|---|---|

| Appropriate structuring and operation of corporate governance | Evaluation of the effectiveness of the Board of Directors | Implement evaluations of the effectiveness of the Board of Directors (including evaluations of improvement processes) | Implemented | |

| Training for officers | Conduct training for officers | Held four lectures given by external parties | ||

Major Initiatives

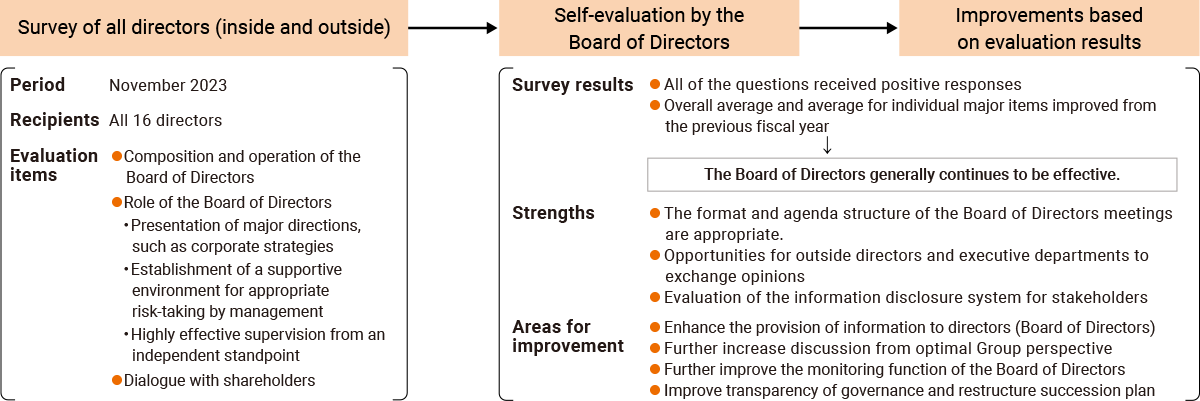

Evaluation of the Effectiveness of the Board of Directors

Since fiscal 2016, the Company’s Board of Directors has conducted annual evaluations of its effectiveness, which serve as a basis for improvement.

In fiscal 2024 the Board of Directors surveyed all directors, including outside directors, during the period from November to December 2024, to evaluate the Board’s effectiveness. The results of the evaluation and analysis were reported at the Board of Directors meetings held on February 27 and March 26, 2025.

In fiscal 2024, we conducted in-depth evaluation of the following items, with support from third-party organizations to ensure the objectivity and transparency of the evaluation process.

Evaluation Items

- 1.Composition and operation of the Board of Directors

- 2.Role of the Board of Directors

- Presentation of major directions, such as corporate strategies

- Establishment of a supportive environment for appropriate risk-taking by management

- Highly effective supervision from an independent standpoint

- 3.Dialogue with shareholders

The survey responses were mostly positive, indicating that the Board of Directors generally continues to be effective. The results also indicated areas with relatively low evaluations where further improvement is needed.

We are therefore working toward implementation of the following.

- 1.Stimulated more active discussion from the optimal perspective for the entire Group through broadening discussions on the Group’s overall management strategies, strategy discussions based on CxO reports, and discussions on capital policies, and further strengthening the leadership role of the chairman of the Board of Directors.

- 2.Further improving the monitoring function of the Board of Directors by providing outside directors with information on risks and investments from a wide range of perspectives.

- 3.Enhancing the provision of information to outside directors by sharing the content of Executive Council discussions and through worksite and business site inspections tours, and other activities.

Additionally, the following initiatives were implemented to “further strengthen the oversight function” and “raise the quality of discussions and explanations by the Board of Directors,” which were identified as issues to address in fiscal 2023.

- 1.Continued improving the transparency of governance (ratio of outside directors on the Board of Directors over 70%, outside director serving as chairman of the Board of Directors) and restructuring the succession plan for the enhancement of the ENEOS Group.

- 2.Discussed management strategy for fiscal 2025 onward from the optimal perspective for the entire Group through the formulation of the fourth Medium-Term Management Plan.

- 3.Enhanced information sharing with outside directors through worksite and business site inspection tours, attendance as an observer in Executive Council by the chairman of the Board of Directors, and interviews of the presidents of principal operating companies conducted by outside directors.

- 4.To stimulate discussions among the Board of Directors, in principle, outside directors and executives met before and after Board of Directors meetings to exchange opinions on specific business policies and other matters.

In addition, the Company’s Audit and Supervisory Committee conducted an evaluation of the effectiveness of the Company’s audit activities in fiscal 2024. Issues are communicated among the Audit and Supervisory Committee members and will be reflected in the audit plan for fiscal 2025, as we seek to construct an effective auditing system.

Process for Evaluation of Effectiveness

Policy for Appointing Director Candidates

The Board of Directors is composed of an appropriate number of members to enable free and constructive discussion and exchange of opinions, with members appointed in consideration of Board diversity and the knowledge, experience, and abilities of each member. The Company appoints independent outside directors* to a majority of director positions. As of June 26, 2025, the percentage of outside independent officers was 70%.

To ensure objectivity and fairness in the selection of director candidates, excluding outside director candidates, a third-party entity evaluates the candidates from various perspectives and appropriate considerations (human resources due diligence and director candidate interviews). Prior to appointment, the Nomination Advisory Committee deliberates the evaluation results and reports to the Board of Directors.

As for directors who are not Audit and Supervisory Committee members, the Company appoints persons with high standards of business ethics, superior strategic thinking and judgment capabilities, and flexible attitudes toward change, as well as the ability to supervise decision-making and management from the viewpoint of what is best for the Group as a whole. Two or more of the directors are independent outside directors.

As for directors who are Audit and Supervisory Committee members, the Company appoints persons with high standards of business ethics, a certain level of specialist knowledge in legal affairs, finance and accounting, etc., as well as the ability to appropriately audit the execution of duties by directors and the ability to appropriately supervise the execution of business. The majority of these directors are independent outside directors.

- *Outside directors who have satisfied the Company’s “Standards for Consideration of Independence of Independent Officers”

Support System for Outside Directors

Each of the four outside directors who are not Audit and Supervisory Committee members and the three outside directors who are Audit and Supervisory Committee members meet the independence standards based on the rules of the Tokyo and Nagoya stock exchanges, on which the Company is listed. The Company sends materials regarding the agenda of meetings of the Board of Directors to the outside directors, in principle, at least three days prior to meetings, and also provides explanations to the outside directors about important agenda items before the meetings. To enhance the auditing function by all Audit and Supervisory Committee members, including outside directors, the Company has established the Office of the Audit and Supervisory Committee, which is clearly independent from the chain of command for divisions responsible for business execution (including personnel evaluations). Full-time staff members have been assigned to the office to assist with the duties of the Audit and Supervisory Committee members. In addition, an organization with full-time staff members has also been established within the Legal and Corporate Affairs Department to assist outside directors who are not Audit and Supervisory Committee members with business execution.

Training for Directors and Corporate Auditors of Principal Operating Companies

The directors of the Company and principal operating companies and the corporate auditors of principal operating companies have the duty of working toward the realization of the Group Philosophy, the sustainable growth of the Group, and the achievement of increased corporate value over the medium to long term. To that end, to enhance necessary knowledge and skills, the Company and its principal operating companies provide opportunities for directors and corporate auditors to receive training related to the Companies Act, internal control systems, accounting and taxes, business strategies, and organizations. In addition, the Company pays expenses related to self-study initiatives. When outside directors are appointed, the Company provides explanations of basic matters regarding the Group’s businesses and, after their appointment, offers business presentations and worksite inspection tours to deepen their understanding.

Results for Fiscal 2024 and Forecast for Fiscal 2025

| Topic | Intended for | Fiscal year | Content of training |

|---|---|---|---|

| Respect for human rights, compliance | Directors and auditors of principal operating companies | 2024 2025 |

Group Philosophy and Code of Conduct, prevention of human rights violations and harassment, etc. |

| Corporate governance | Newly appointed | 2024 2025 |

ENEOS Group corporate governance |

| Internal control | Newly appointed | 2024 2025 |

ENEOS Group risk management systems |

| Finance and investor relations | Newly appointed | 2024 2025 |

Current status and issues regarding ENEOS Holdings’ financial affairs, opinions of institutional investors, etc. |

| ENEOS Holdings and principal operating companies | Newly appointed directors (outside directors) | 2024 2025 |

Basic knowledge about ENEOS Holdings and its principal operating companies |

| Worksite inspection tours | Outside directors | 2024 |

(ENEOS Holdings) Central Technical Research Laboratory, (ENEOS) Kawasaki Refinery, (Osaka International Refining Company) Chiba Refinery, (ENEOS Materials) Chiba Plant |

| 2025 (Planned) | (ENEOS) Sendai Refinery, Tohoku Branch Office, (ENEOS Renewable Energy) Shirakawa Solar Park, Azuma Kogen Wind Farm |

Determination of Director Remuneration

Directors Who Are Not Audit and Supervisory Committee Members (Excluding Outside Directors)

The policy on remuneration for individual directors who are not Audit and Supervisory Committee members (excluding outside directors) is determined as follows.

- 1.Remuneration consists of the monthly remuneration, bonus, and share-based remuneration.

- 2.Remuneration is determined by whether the person belongs to the Company or a principal operating company, whether the person is full-time or part-time, whether the person is a director or executive officer, etc.

- 3.Bonuses are linked to performance within a fiscal year, and are paid after the given fiscal year.

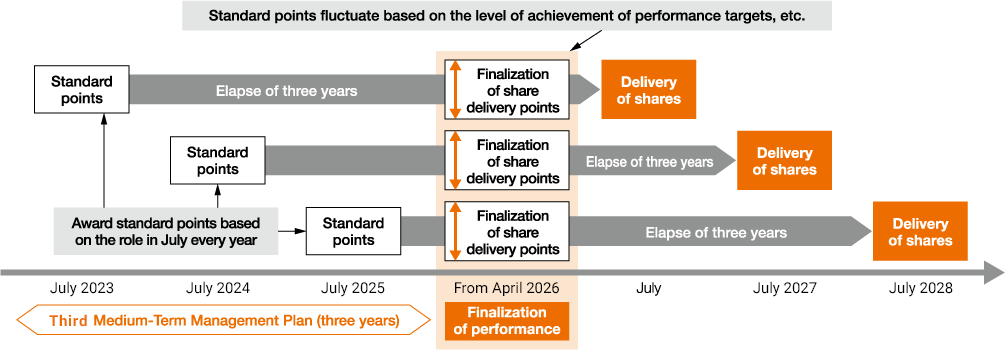

- 4.Share-based remuneration consists of a fixed component based on role and a performance-linked component that fluctuates based on the level of achievement of performance targets, etc. under a medium-term management plan. It is paid after a certain duration from the end of the fiscal year in which the duties have been executed and after the given medium-term management plan has been completed.

- 5.The consolidated business results, remuneration levels of executives in other companies, composition ratio, etc. are taken into consideration when determining the remuneration level, composition ratio, performance indicators, etc.

Remuneration for directors who are not Audit and Supervisory Committee members (excluding outside directors) is designed to be around 40% of the total for monthly remuneration, around 30% of the total for bonuses, and around 30% of the total for share-based remuneration when the performance targets, etc. are achieved. In addition, the Company may request that remuneration and other compensation be returned and/or forfeited in accordance with the provisions of the Officer Appointment Contract and rules and regulations regarding disciplinary measures for officers. The maximum amount of the remuneration and compensation subject to return and/or forfeit is the total amount for four fiscal years.

Outside Directors Who Are Not Audit and Supervisory Committee Members

The policy on remuneration for individual outside directors who are not Audit and Supervisory Committee members is to provide a monthly remuneration only in consideration of their roles of providing guidance and advice to Company management and supervising management from an independent and objective perspective.

The policy on remuneration for individual directors who are not Audit and Supervisory Committee members of the Company is determined by resolution of the Board of Directors after deliberation and recommendation by the Compensation Advisory Committee, which consists of a majority of outside directors and is chaired by an outside director. The Board of Directors allows the Audit and Supervisory Committee to select one member to attend meetings of the Compensation Advisory Committee so that the Audit and Supervisory Committee may adequately exercise the right to state opinions related to the remuneration of directors who are not Audit and Supervisory Committee members at General Meetings of Shareholders.

Directors Who Are Audit and Supervisory Committee Members (Including Outside Directors)

Remuneration for directors who are Audit and Supervisory Committee members consists of a monthly remuneration only in consideration of the independence of their roles based on discussions among directors who are Audit and Supervisory Committee members. The parameters of the remuneration are shown in the following table.

Upper Limit of Remunerations for Directors

| Category | Type | Upper limit of remuneration | Resolution of the General Meeting of Shareholders (GMS) | Number of receivers (Persons) |

|---|---|---|---|---|

| Directors who are not Audit and Supervisory Committee members | Monthly remuneration and bonuses | No more than 1,100 million yen per one (1) fiscal year (of which no more than 200 million yen is allocated to outside directors who are not Audit and Supervisory Committee members) | The 8th ordinary GMS (June 27, 2018) |

13 |

| Share-based remuneration | In every three (3) fiscal years,

|

The 15th ordinary GMS (June 26, 2025) |

2 | |

| Directors who are Audit and Supervisory Committee members | Monthly remuneration | No more than 200 million yen per one (1) fiscal year | The 8th ordinary GMS (June 27, 2018) |

5 |

- Note:

- Those eligible for share remuneration include executive officers but do not include outside directors and overseas residents.

Remunerations for Directors (Fiscal 2024)

| Category | Total amount (Million yen) | Details of remuneration (Million yen) | Number of receivers (Persons) | Details of remuneration (Million yen) | Number of receivers (Persons) | Details of remuneration (Million yen) | Number of receivers (Persons) |

|---|---|---|---|---|---|---|---|

| Monthly remuneration | Bonuses | Share-based remuneration | |||||

| Directors who are not Audit and Supervisory Committee members (Outside directors) |

390 (81) |

228 (81) |

11 (4) |

96 (-) |

2 (-) |

66 (-) |

2 (-) |

| Directors who are Audit and Supervisory Committee members (Outside directors) |

111 (66) |

111 (66) |

8 (6) |

- (-) |

- (-) |

- (-) |

- (-) |

| Total (Outside directors) |

501 (147) |

339 (147) |

19 (10) |

96 (-) |

2 (-) |

66 (-) |

2 (-) |

- 1. The information in the table includes the amount of remunerations for five (5) directors who were not Audit and Supervisory Committee members, four (4) directors who were Audit and Supervisory Committee members (including three [3] outside directors who were Audit and Supervisory Committee members) who retired upon the conclusion of the 14th Ordinary General Meeting of Shareholders held on June 26, 2024.

- 2. Includes the amount of bonuses received for fiscal 2024 after the conclusion of the 15th Ordinary General Meeting of Shareholders.

- 3.Bonuses and share-based remuneration are applicable to performance-linked remunerations. In addition, share-based remuneration is applicable to non-monetary remunerations.

- 4. The share-based remuneration amounts indicated in the table are the average price per share of the Company purchased through the trust that the Company established multiplied by the number of standard points awarded to the Director in the fiscal year and the performance-linked coefficient.

Matters Concerning Bonuses

Bonuses are linked to performance within a single fiscal year and can fluctuate between 0% and 200% (target: 100%) depending on the level of achievement of the performance targets. Bonuses are determined by multiplying the monthly remuneration by the base number of months (8 months) and the percentage of target achieved.

The indicators that affect shareholder returns and the indicators that reflect the actual performance should be used when calculating the percentage of target achieved. Therefore, the Company’s consolidated results, “profit attributable to owners of parent” and “profit attributable to owners of parent after adjustment” are selected to be used as performance indicators with the weight of 50% each.

The fiscal 2024 performance target for the bonus calculation process was set based on projections of the fiscal 2024 results (disclosed in May 2024), and the resulting percentage of target achieved was 121%. The results of each performance indicator to calculate the percentage of target achieved are as follows.

Results for Each Performance Indicator for Bonuses

| Performance indicators | Weight | Results in FY2024 |

|---|---|---|

| Profit attributable to owners of parent | 50% | 226,100 million yen |

| Profit attributable to owners of parent after adjustment | 50% | 285,000 million yen |

- Note:

- “Profit attributable to owners of parent after adjustment” is calculated by adding or subtracting temporary gain/loss, such as gain/loss on valuation of inventory, gain/loss on sale of fixed assets and shares, and loss by disasters, to or from profit attributable to owners of parent.

Matters Concerning Share-based Remuneration

Share-based remuneration consists of a fixed component determined based on the role and a performance-linked component that fluctuates based on the level of achievement of performance targets, etc. under a medium-term management plan. The performance-linked component fluctuates within a range of 0% and 200% (target: 100%) based on the level of achievement of performance targets, etc. Of the standard points awarded to eligible persons, the share delivery points (one share per point) consist of a fixed component, which is finalized as share delivery points after the conclusion of the end of the applicable period based on the recipient’s role, and a performance-linked component that fluctuates between 0% and 200% based on the level of achievement of performance targets, etc. and is determined as share delivery points. Eligible persons shall receive payment of money and the Company’s shares through the trust created by the Company, according to the number of share delivery points, after the lapse of three years from the award of standard points of each year.

The indices, targets, and composition ratios used as the Company’s performance targets, etc. in the plan period are determined by the time of the first award of standard points in the plan period after deliberation by the Compensation Advisory Committee. The indices for the plan period covering the three fiscal years in the fourth Medium-Term Management Plan are relative TSR (against TOPIX and against a group of peer companies in the same sector) and ROIC.

Flowchart of Share Remuneration with Regard to the Period of the Fourth Medium-Term Management Plan

Selection of Independent Auditor

The selection, dismissal, or non-reappointment of the Independent Auditor is resolved every fiscal year in accordance with the policy established by the Audit and Supervisory Committee. Prior to the resolution, the Independent Auditor is evaluated once a year in accordance with the standards established by the Audit and Supervisory Committee.

The Audit and Supervisory Committee has resolved to reappoint the current Independent Auditor as it has been confirmed that there are no issues pertaining to the evaluation items, that the Independent Auditor has sufficient systems and ability to handle the Company’s audit work, and that there are no grounds for dismissal or non-reappointment.

The rotation of executive Representative Partners of the current Independent Auditor has been implemented appropriately, and they have not been involved in the Company’s audit operations for more than seven consecutive fiscal years. The head Representative Partner has not been involved in the Company’s audit operations for more than five consecutive fiscal years.

Governance of Listed Subsidiaries

The Company maintains ENEOS Corporation, ENEOS Xplora Inc., ENEOS Materials Corporation, ENEOS Power Corporation, and ENEOS Renewable Energy Corporation, its principal operating companies, as wholly owned subsidiaries or specially controlled companies, and maintains other Group companies as wholly owned subsidiaries, listed subsidiaries, listed affiliates, or other types of entities based on the need to maintain or expand its businesses. The policy of the Board of Directors is to regularly examine the appropriateness of maintaining a company as a listed subsidiary or listed affiliate from the perspective of improving the Group’s overall corporate value and capital efficiency, to consider the reasonableness of maintaining the listed company status, and to deliberate on the effectiveness of the listed subsidiary’s governance system.

The Company maintains no listed subsidiaries.

Policy on Strategic Shareholdings

Strategic Shareholdings

- Note:

- In association with the listing of JX Advanced Metals, we are reviewing the exclusions, etc. regarding strategic shareholdings owned by JX Advanced Metals.

In accordance with the Basic Policy on Corporate Governance of ENEOS Group, in principle, the Company shall not hold shares in listed companies. As an exception, the Company may hold shares in listed companies as strategic shareholdings, as described below.

- 1) Shares in companies which engage in any important businesses of ENEOS Group

- 2) Shares in companies which ENEOS Group judges necessary to maintain or enlarge business of ENEOS Group

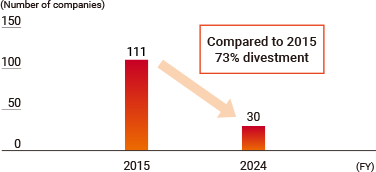

The Company has divested 79% of its strategic shareholdings since the above policy was adopted in November 2015. In fiscal 2024, the Company sold shares (valued at 12,192 million yen)* of six companies and did not acquire any new strategic shareholdings.

- *Includes partial divestment of shareholdings

Method of Verifying the Rationality of Possession

With respect to exceptionally holding strategic shareholdings, the Company shall periodically assess whether or not to hold each individual strategic shareholding, specifically examining whether the purpose is appropriate and whether the benefits and risks from each holding cover the company’s cost of capital at the Board of Directors meeting of the Company.

Board of Directors Verification of the Appropriateness of Individual Strategic Shareholdings

The Company assessed whether or not to hold each individual strategic shareholding, specifically examining whether the purpose is appropriate and whether the benefits (transactional profits, dividends, benefits difficult to quantify) and risks from each holding cover the company’s cost of capital at the Board of Directors meeting of the Company in November 2024.

Risk Management

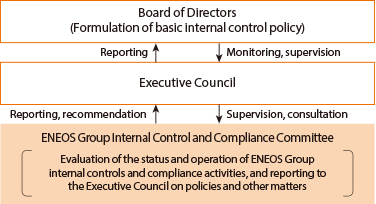

The ENEOS Group has established the Basic Policy on Internal Control System for the development and implementation of a system for ensuring the appropriateness of our business operations.

Comprehensive Risk Management Structure

Based on the risk management system, which is standard throughout the Group, the Risk Management Council (Executive Council) convenes three times a year, in principle. It selects material risks for the Group and formulates mitigation* plans, and checks the status of internal control activities for the previous fiscal year, as well as action policies for the next fiscal year. Additionally, in April 2025, the position of CRO (Chief Risk Officer) and the Risk Management Department were established to enable appropriate identification and analyzation of Group management risks and the implementation of accurate responses.

The Board of Directors monitors and supervises the internal control systems for the entire Group as appropriate, based on reports of the proceedings of the Risk Management Council.

- * Measures to reduce risk to a tolerable level

Risk Management System at Principal Operating Companies

The Group’s principal operating companies have developed and operate their own risk management systems, which are tailored to their specific business content and characteristics. The departments in charge of risk management at the Company and the principal operating companies cooperate and share risk information with each other.

Enterprise Risk Management (ERM)

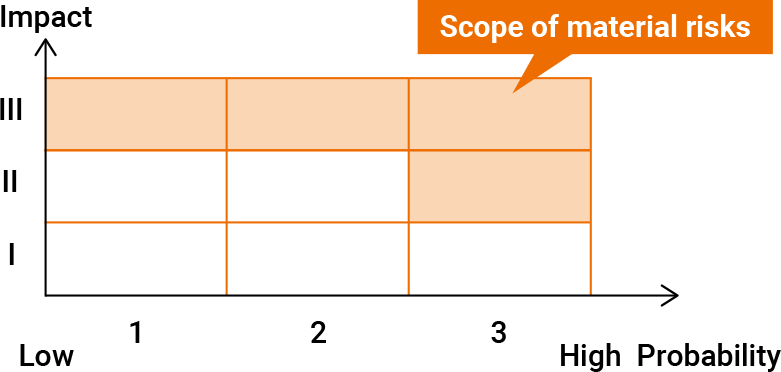

Risk Assessment Matrix

The Company has developed and operates a Group-wide risk management system based on the ENEOS Group Risk Management Basic Policies.

Risks are identified and analyzed, taking into account risks identified up to the previous fiscal year, as well as increased risks and potential new risks arising from changes inside and outside the Company, and are assessed for materiality based on the degree of impact and probability. Risks that are indicated by assessment results as requiring a response from the Group are designated as material risks by resolution of the Executive Council, which is chaired by the CEO of the Company. Departments are designated for response to material risks, and monitoring is carried out by reporting the status of response to the Executive Council.

Impact

| Qualitative criteria | |

|---|---|

| High | Potential for significant impact on the entire Group, immediate implementation of countermeasures by the entire Group required |

| Medium | Potential for some degree of impact on the entire Group, consideration of specific countermeasures by the entire Group required |

| Low | Potential for minimal impact on the Group as a whole, response can be implemented by individual Group companies |

- Note:

- In addition to the table above, we also use assessment criteria for each incident, such as personal injuries and compliance violations.

Probability

| Qualitative criteria | |

|---|---|

| High | Has already occurred or is very likely to occur within the next three years |

| Medium | Is very likely to occur within the next 10 years |

| Low | Has a certain probability of occurring within the next 10 to 40 years |

- Note:

- In addition to the table above, we also use assessment criteria that take into account factors such as the frequency of past occurrences at Group companies and at other companies.

Internal Control

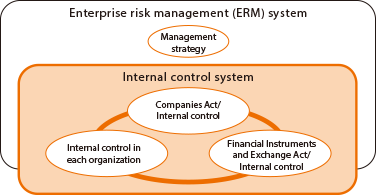

The Group has developed and operates an internal control system. The system links the internal controls stipulated in the Companies Act and the Financial Instruments and Exchange Act, and the internal controls of each Group organization* to each other.

Additionally, in order to respond to the rapidly changing external environment and the increasing diversity of risks faced by the Group, we promote Group-wide internal control activities and are strengthening controls to prevent and discover incidents of noncompliance and misconduct throughout the Group. Moreover, the Company supports internal controls implemented autonomously by principal operating companies through the development of best practices for internal control activities in the Group.

- *Internal control in each organization is constructed based on the COSO (Committee of Sponsoring Organizations of the Treadway Commission) framework, adopted by countries around the world.

Internal Control Inspections

We conduct internal control inspections annually as a voluntary initiative at each worksite.

We inspect each business operation to ascertain compliance with Group-wide rules (internal control standards). In addition, given the rapidly changing management environment, we use a risk control matrix (RCM) to ascertain whether risks have been appropriately identified and assessed, and whether effective controls for these risks have been developed and implemented. We take prompt action to correct any issues identified through these inspections and revise controls to prevent recurrence, using the PDCA cycle to achieve continuous improvements.

Fostering a Risk Culture

To strengthen our risk management, the Group is working to improve organizational structures as well as foster a risk culture*. In fiscal 2025 we plan to undertake initiatives to instill risk awareness throughout the organization through training for executives and e-learning for all employees. This risk awareness includes the proper execution of operations while maintaining an awareness of risks, and the practice of giving bad news first. We also plan to conduct annual surveys to assess the degree of permeation of risk awareness and to regularly check the status of this permeation within the organization while taking further measures to foster the development of a risk culture.

- *An organizational culture where beliefs, attitudes, and behaviors regarding risk are shared by everyone, from management to employees

Risk Assessment of Business Activities

The Group has internal rules and regulations for addressing the risks in its business activities. For the screening of new investments, in addition to country risks and foreign exchange rate risks, we analyze and evaluate ESG-related risks, including environmental risks such as those related to the scope of response to biodiversity and environmental regulations; risks in the procurement of raw materials, including water; and human resources risks, including those related to human rights and occupational health and safety, and we take appropriate actions when necessary.

In addition, when reviewing proposed major investments, we perform screenings based on the stage-gate system. The process from initial examination to execution of an investment project is divided into multiple stages of examination, and deliberations are conducted at each stage. During the deliberations, we work to identify various risks, including ESG-related risks, using sensitivity analysis and case analysis, and work to gain a multifaceted, quantitative grasp of risks using methods such as cold-eye review by a third party. For important investments, investment reappraisal is carried out after a certain period of time to assess and analyze impacts on the initial outlook caused by environmental changes or other factors and to determine whether to continue with the project.

Crisis Management

In the event of a crisis situation that could significantly affect the management of the Group, the Company responds quickly and appropriately in accordance with the ENEOS Group Risk Management Basic Policies and the ENEOS Group Accident and Trouble Reporting and Response Guidelines, and has systems in place to minimize any damage that may occur. Our basic stance on crisis situations is to place the highest priority on protecting human life, issue information promptly and implement centralized information management, quickly determine, execute, and follow up the most effective response measures, implement transparent and smooth communications, and prevent recurrence of accidents and troubles.

With the Risk Management Department as the standing organizational unit in the event of a crisis situation, we maintain a system enabling immediate reporting on conditions and the status of response measures from each relevant Company department or Group company at the site of an incident as required by the degree of impact. Depending on the magnitude of the crisis, we may set up a response headquarters, led by the Company CEO, to ensure agile and effective response.

Infectious Disease Prevention Measures

The Group’s basic policy is to (1) place the highest priority on respect for human life and make every effort to protect against and prevent the spread of infectious diseases to the Group’s officers, employees and their families, and (2) engage all Group companies in maintaining a continuous supply of our products, which support the functioning of society. In the event that management is significantly affected by an infectious disease epidemic, a system is in place to set up a response headquarters, led by the president, to ensure the prompt determination and execution of countermeasures.

ENEOS has business continuity plans at its head office, branch offices, refineries, and other sites to ensure that we can fulfill our responsibility of providing a stable supply of petroleum products, even during an epidemic. To protect employees from infection and prevent the spread of disease, we systematically stockpile surgical masks, goggles, alcohol-based disinfectants, and other items at our business sites in Japan and overseas. We also maintain a system and an IT environment that enable employees to work from home.

Information Security

The Group implements necessary security measures based on its recognition that the maintenance of a high level of information security is an important management issue. The Group has established the Information Security Policy, under which it handles, manages, protects, and maintains information, including that related to business partners and subcontractors, in an appropriate manner.

Company information is an important asset of the Group, and we work to prevent the improper use, disclosure, or leakage of this information in accordance with the ENEOS Group Basic Rules for Information Security. The Group also strives to maintain information accuracy and reliability and to prevent falsification or mishandling while ensuring that information is available to authorized users when needed.

In addition, the Company and ENEOS have developed personal information protection procedures and established rules to ensure compliance with the Personal Information Protection Act and the appropriate handling of personal information to protect people’s rights.

In fiscal 2024, as in the previous fiscal year, we conducted training using e-learning for all employees of the Company and ENEOS.

At the Company and ENEOS, when a leak of personal information is detected, it is immediately shared among the relevant departments and reported to the Personal Information Protection Commission as necessary. In such cases, we conduct prompt root cause analysis and response to prevent the spread of damage. We are also working to prevent recurrence through efforts such as providing training on personal information protection laws to all employees. We will continue working to strengthen our personal information management systems to ensure appropriate management.

Cybersecurity Measures

In order to protect its important information and systems from cyberattacks, which have become stealthier in recent years, the Group has established the ENEOS Group Cybersecurity Council, chaired by the CEO of the Company. The council checks the status of cybersecurity measures, and also determines and implements cybersecurity measures using a top-down approach.

In addition, the IT Security Procedures for ENEOS Group have been established and communicated to Group companies to ensure that cybersecurity countermeasures are carried out across the entire Group. The procedures require the appointment of IT cybersecurity managers to implement and oversee IT security measures at each Group company. The procedures also stipulate that disciplinary action is to be taken in the event that an employee violates the procedures and causes damage to the company.

For employees, as ongoing initiatives, the ENEOS Group conducts drills and issues reminders on the handling of suspicious emails, and also provides Group-wide security training using curricula translated into multiple languages.

Protection of Intellectual Property

The ENEOS Group Code of Conduct states that all Group companies will properly maintain, manage, and protect corporate tangible and intangible assets along with new discoveries made in the course of business activities, as well as respect the intellectual property rights of third parties.

ENEOS Group Code of Conduct (excerpt)

- 7.Equitable and fair transactions

- (3)We respect the intellectual property rights of third parties.

- 10.Corporate asset protection and management

- (1)We properly maintain, manage, and protect corporate tangible and intangible assets.

- (2)We shall not use corporate tangible and intangible assets for purposes other than business activities.

- (3)We protect new discoveries or inventions made in the course of business activities as corporate intellectual properties.

ENEOS manages and uses intellectual property appropriately in accordance with internal rules on intellectual property (“Employee Invention Compensation Regulations”). Given the importance of intellectual property to our current business strategies, we actively manage intellectual property to contribute to our business development. To ensure respect for third-party intellectual property rights, the relevant departments work together on measures related to intellectual property and steps are taken to raise employee awareness of intellectual property rights.

Number of Registered Patents (As of March 31, 2025)

| Japan | Overseas | Total | |

|---|---|---|---|

| Number of registered patents | 1,853 | 2,491 | 4,344 |

- Note:

- Data from ENEOS and ENEOS Materials